Home /

Expert Answers /

Accounting /

at-year-end-a-trial-balance-showed-total-credits-exceeding-total-debits-by-6-200-this-difference-pa737

(Solved): At year-end, a trial balance showed total credits exceeding total debits by $6,200. This difference ...

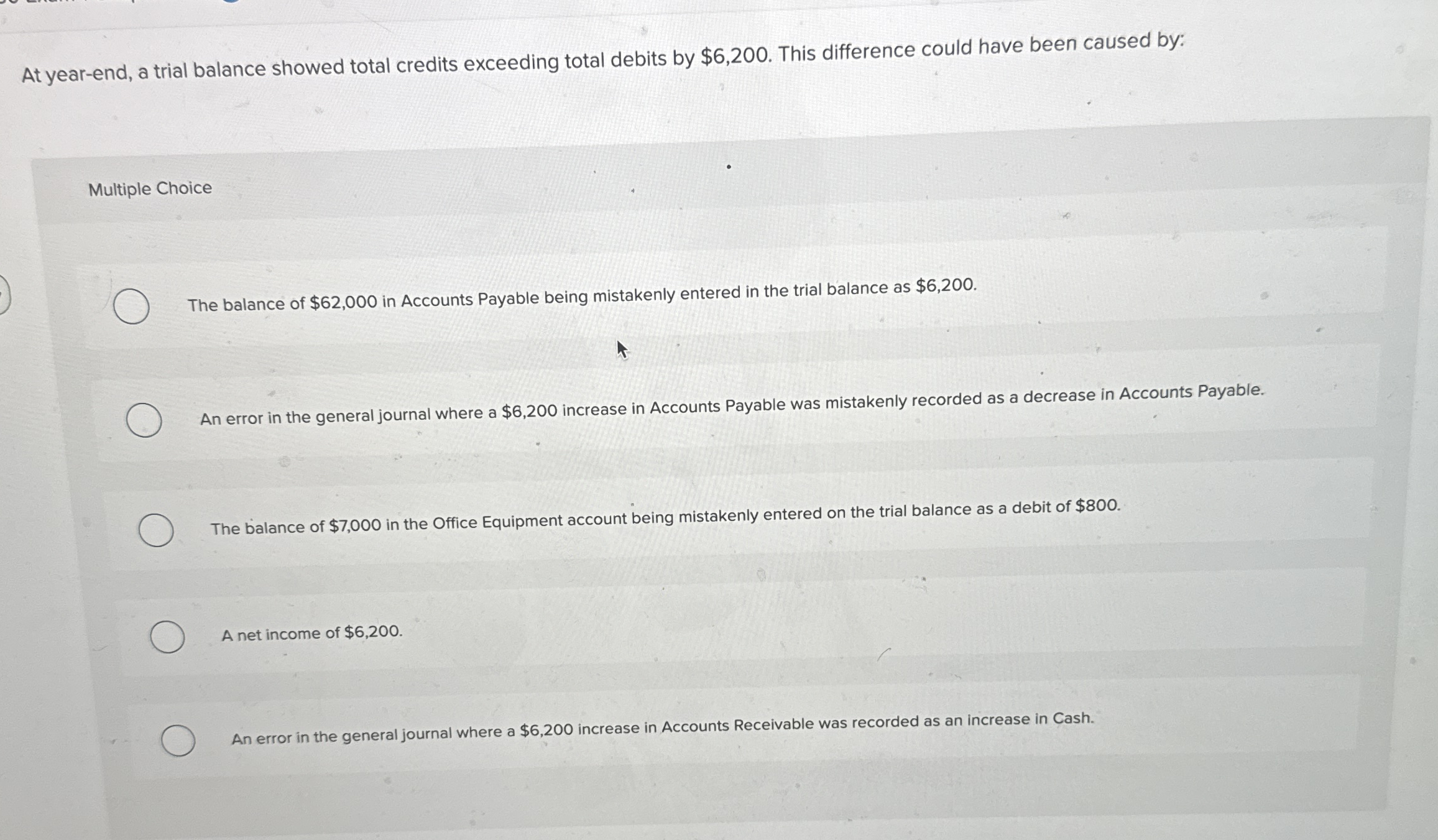

At year-end, a trial balance showed total credits exceeding total debits by

$6,200. This difference could have been caused by: Multiple Choice The balance of

$62,000in Accounts Payable being mistakenly entered in the trial balance as

$6,200. An error in the general journal where a

$6,200increase in Accounts Payable was mistakenly recorded as a decrease in Accounts Payable. The balance of

$7,000in the Office Equipment account being mistakenly entered on the trial balance as a debit of

$800. A net income of

$6,200. An error in the general journal where a

$6,200increase in Accounts Receivable was recorded as an increase in Cash.