Home /

Expert Answers /

Finance /

assume-gillette-corporation-will-pay-an-annual-dividend-of-0-65-one-year-from-now-analysts-expect-pa370

(Solved): Assume Gillette Corporation will pay an annual dividend of $0.65 one year from now. Analysts expect ...

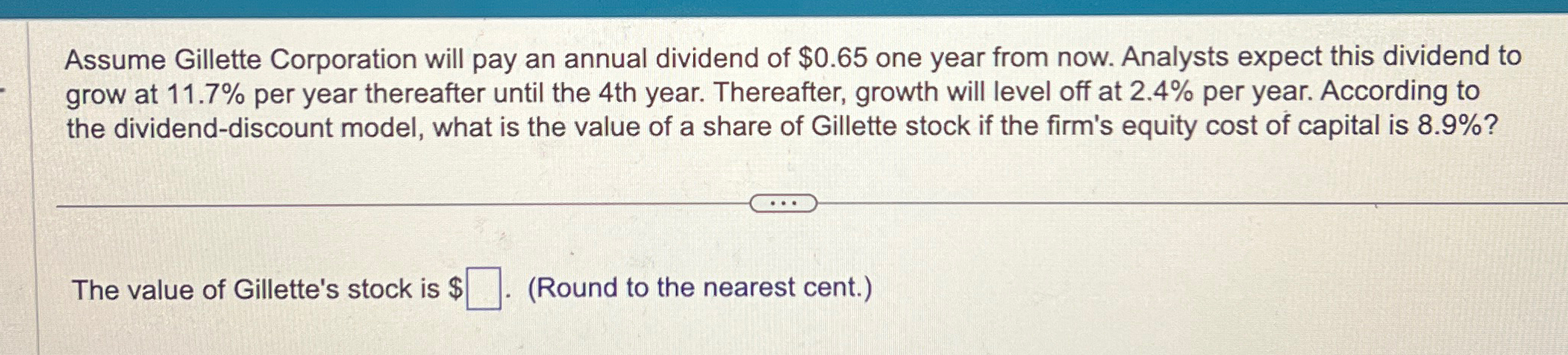

Assume Gillette Corporation will pay an annual dividend of

$0.65one year from now. Analysts expect this dividend to grow at

11.7%per year thereafter until the 4 th year. Thereafter, growth will level off at

2.4%per year. According to the dividend-discount model, what is the value of a share of Gillette stock if the firm's equity cost of capital is

8.9%? The value of Gillette's stock is

$

◻(Round to the nearest cent.)