Home /

Expert Answers /

Accounting /

all-mulitple-choice-please-help-journalize-the-following-considering-the-seller-is-a-service-provi-pa876

(Solved): all mulitple choice please help!! Journalize the following considering the seller is a SERVICE provi ...

all mulitple choice please help!!

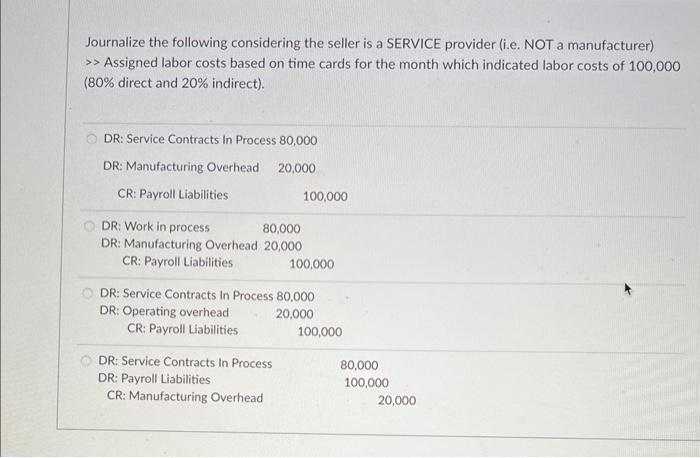

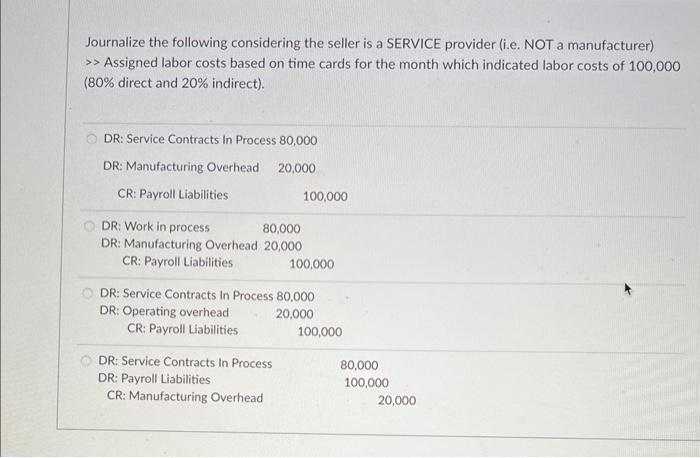

Journalize the following considering the seller is a SERVICE provider (i.e. NOT a manufacturer) >> Assigned labor costs based on time cards for the month which indicated labor costs of 100,000 ( \( 80 \% \) direct and \( 20 \% \) indirect).

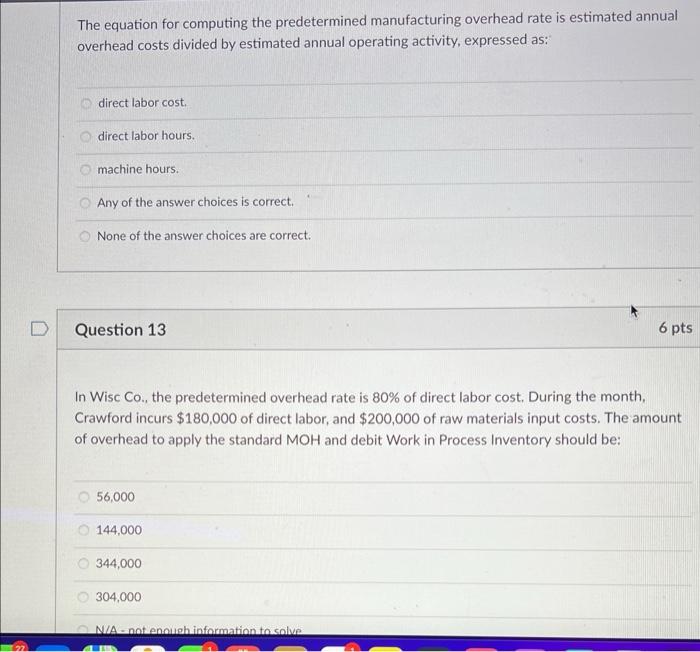

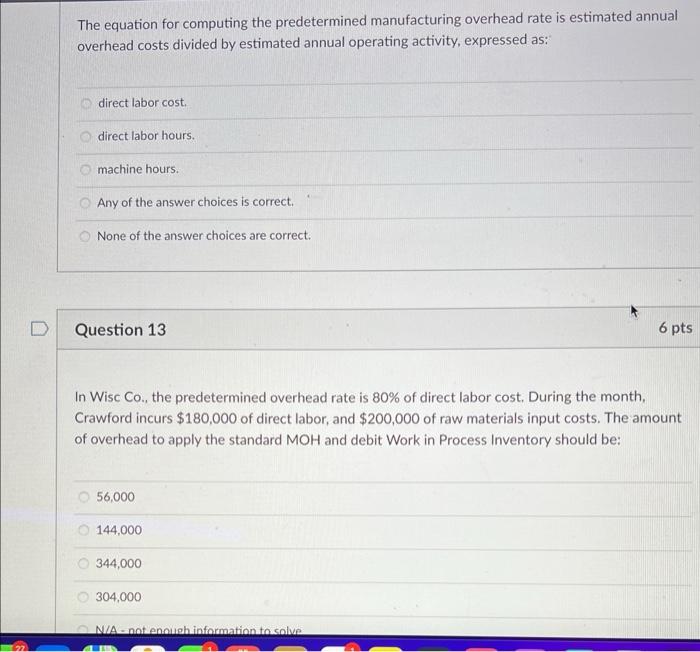

The equation for computing the predetermined manufacturing overhead rate is estimated annual overhead costs divided by estimated annual operating activity, expressed as: direct labor cost. direct labor hours. machine hours. Any of the answer choices is correct. None of the answer choices are correct. Question 13 In Wisc Co., the predetermined overhead rate is \( 80 \% \) of direct labor cost. During the month, Crawford incurs \( \$ 180,000 \) of direct labor, and \( \$ 200,000 \) of raw materials input costs. The amount of overhead to apply the standard \( \mathrm{MOH} \) and debit Work in Process Inventory should be: 56,000 144,000 344,000 304,000

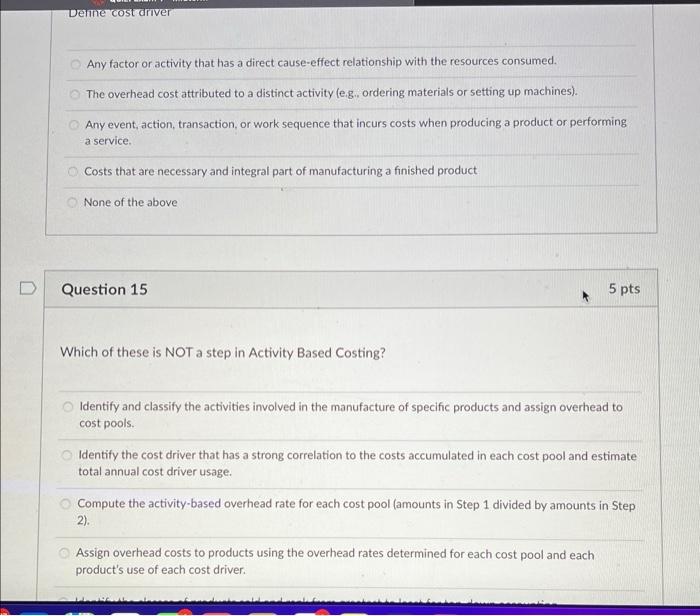

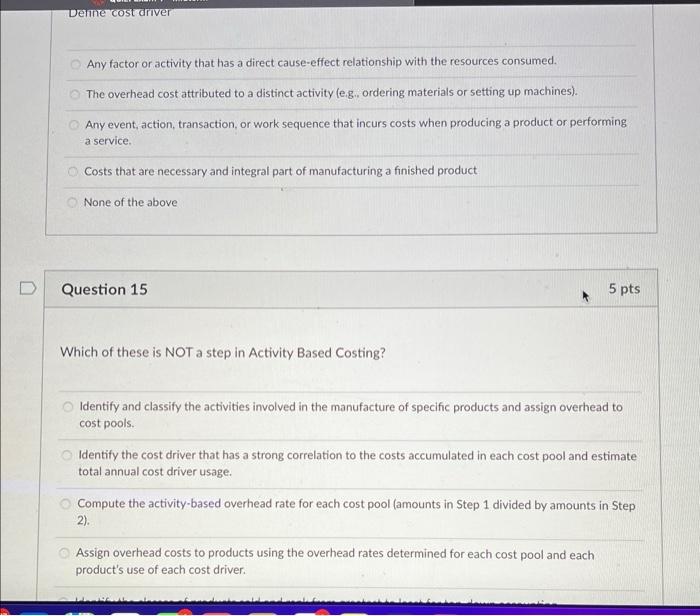

Any factor or activity that has a direct cause-effect relationship with the resources consumed. The overhead cost attributed to a distinct activity (e.g., ordering materials or setting up machines). Any event, action, transaction, or work sequence that incurs costs when producing a product or performing a service. Costs that are necessary and integral part of manufacturing a finished product. None of the above Question 15 5 pts Which of these is NOT a step in Activity Based Costing? Identify and classify the activities involved in the manufacture of specific products and assign overhead to cost pools. Identify the cost driver that has a strong correlation to the costs accumulated in each cost pool and estimate total annual cost driver usage. Compute the activity-based overhead rate for each cost pool (amounts in Step 1 divided by amounts in Step 2). Assign overhead costs to products using the overhead rates determined for each cost pool and each product's use of each cost driver.

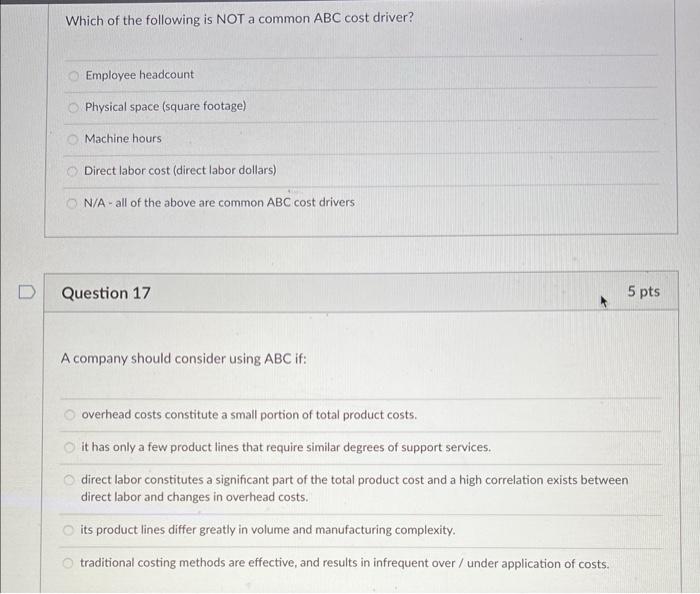

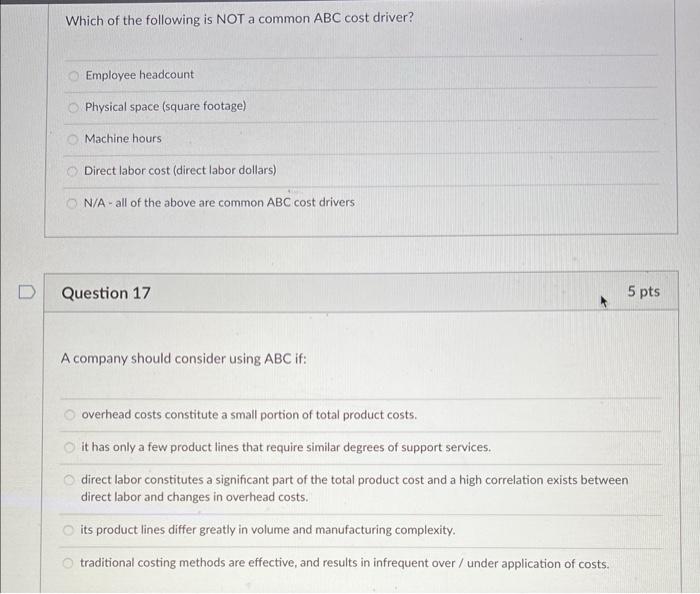

Which of the following is NOT a common ABC cost driver? Employee headcount Physical space (square footage) Machine hours Direct labor cost (direct labor dollars) N/A - all of the above are common \( A B C \) cost drivers Question 17 5 pts A company should consider using \( A B C \) if: overhead costs constitute a small portion of total product costs. it has only a few product lines that require similar degrees of support services. direct labor constitutes a significant part of the total product cost and a high correlation exists between direct labor and changes in overhead costs. its product lines differ greatly in volume and manufacturing complexity. traditional costing methods are effective, and results in infrequent over / under application of costs.

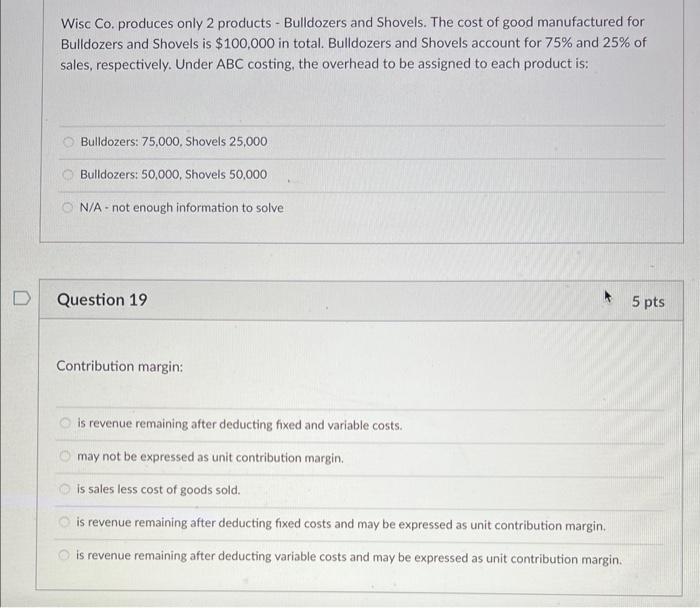

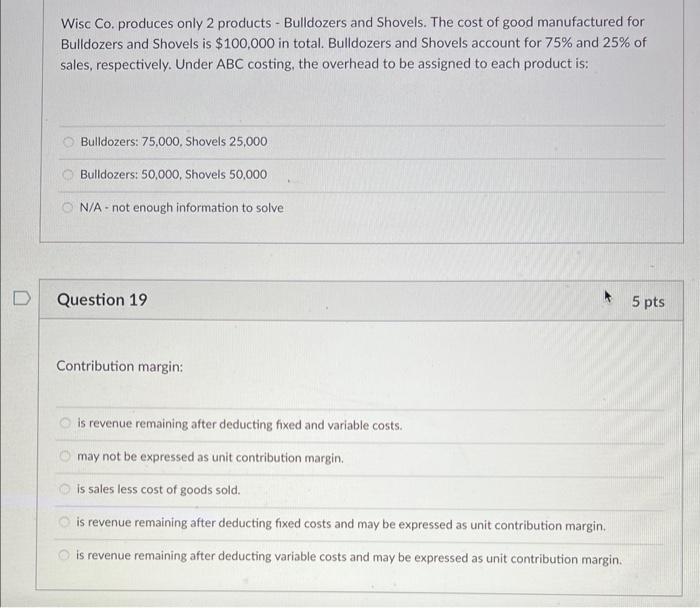

Wisc Co. produces only 2 products - Bulldozers and Shovels. The cost of good manufactured for Bulldozers and Shovels is \( \$ 100,000 \) in total. Bulldozers and Shovels account for \( 75 \% \) and \( 25 \% \) of sales, respectively. Under \( A B C \) costing, the overhead to be assigned to each product is: Bulldozers: 75,000, Shovels 25,000 Bulldozers: 50,000, Shovels 50,000 N/A - not enough information to solve Question 19 5 pts Contribution margin: is revenue remaining after deducting fixed and variable costs. may not be expressed as unit contribution margin. is sales less cost of goods sold. is revenue remaining after deducting fixed costs and may be expressed as unit contribution margin. is revenue remaining after deducting variable costs and may be expressed as unit contribution margin.