(Solved): A sports-car manufacturing company "MLTR" currently has warehouse in three locations, i.e., Denver ...

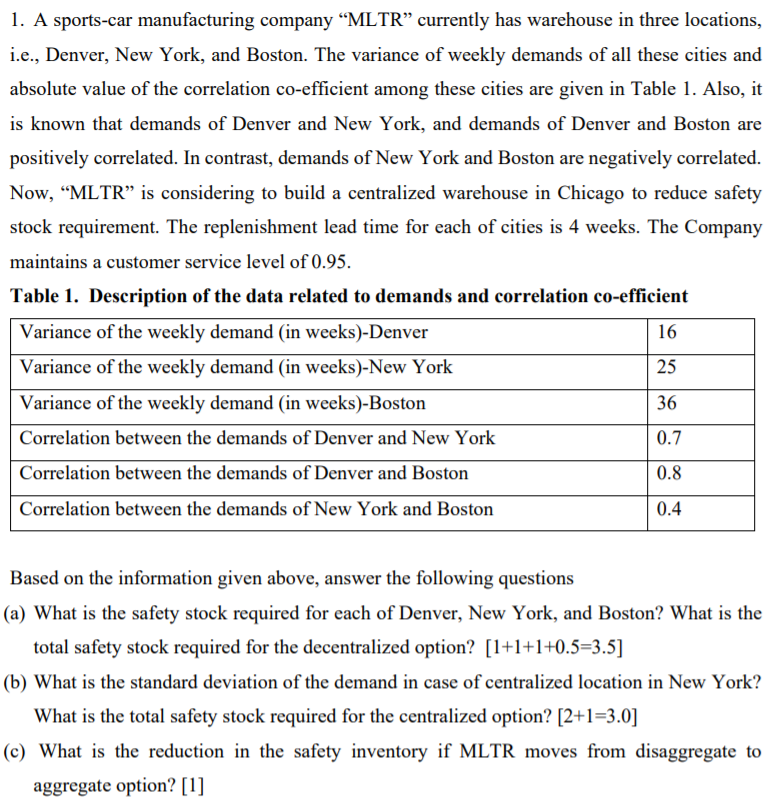

A sports-car manufacturing company "MLTR" currently has warehouse in three locations, i.e., Denver, New York, and Boston. The variance of weekly demands of all these cities and absolute value of the correlation co-efficient among these cities are given in Table 1. Also, it is known that demands of Denver and New York, and demands of Denver and Boston are positively correlated. In contrast, demands of New York and Boston are negatively correlated. Now, "MLTR" is considering to build a centralized warehouse in Chicago to reduce safety stock requirement. The replenishment lead time for each of cities is 4 weeks. The Company maintains a customer service level of 0.95 . Table 1. Description of the data related to demands and correlation co-efficient Based on the information given above, answer the following questions (a) What is the safety stock required for each of Denver, New York, and Boston? What is the total safety stock required for the decentralized option?

1+1+1+0.5=3.5(b) What is the standard deviation of the demand in case of centralized location in New York? What is the total safety stock required for the centralized option?

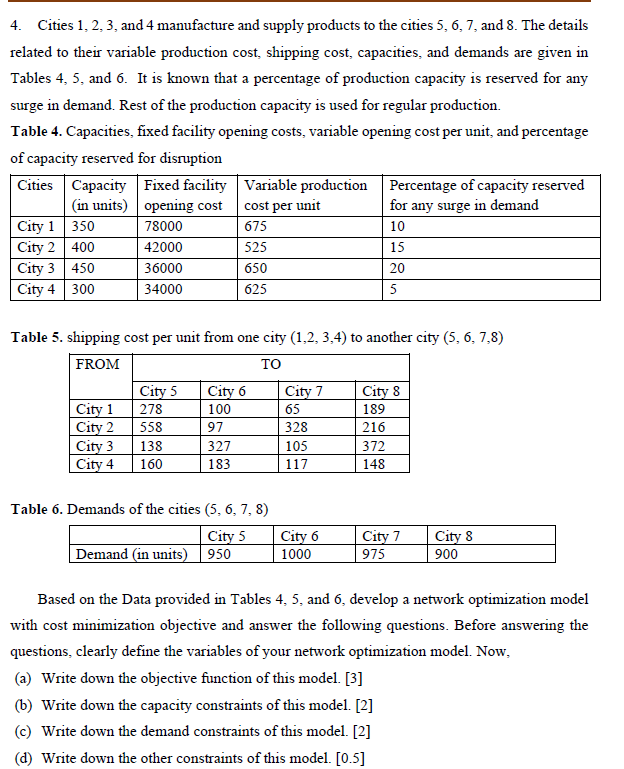

2+1=3.0(c) What is the reduction in the safety inventory if MLTR moves from disaggregate to aggregate option? [1] Sports star is a sports equipment retailer. Demand for sports equipment is 600 sports equipment per month. DO incurs a fixed order placement, transportation, and receiving cost of

$100each time an order for the sports equipment is placed with the manufacturer. Sports star incurs a holding cost of 20 percent. The price charged by the manufacturer follows the Marginal unit discount pricing schedule is shown following. Table 3. Pricing schedule offered by Sports star Based on the information given above, answer the following questions (a) what is the " V " values for each of the ranges?

0.25+0.25+0.25+0.25=1(b) what is the unadjusted order quantity for each of the ranges?

0.25+0.25+0.25+0.25=1(c) what is the adjusted order quantity for each of the ranges?

0.25+0.25+0.25+0.25=1(d) what is the ordering cost for each of the ranges?

0.25+0.25+0.25+0.25=1(e) what is the holding cost for each of the ranges? [0.25+0.25+0.25+0.25=1] (f) what is the material cost for each of the ranges?

0.25+0.25+0.25+0.25=1(g) what is the total cost for each of the ranges?

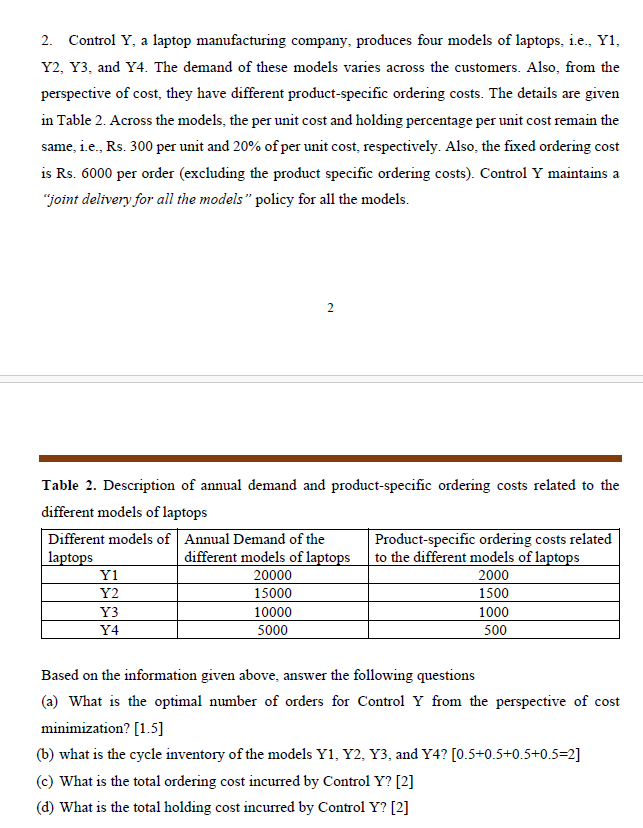

0.25+0.25+0.25+0.25=1(h) What is the final ordering decision of "Sports Star"? [0.5] Cities

1,2,3, and 4 manufacture and supply products to the cities

5,6,7, and 8. The details related to their variable production cost, shipping cost, capacities, and demands are given in Tables 4,5 , and 6 . It is known that a percentage of production capacity is reserved for any surge in demand. Rest of the production capacity is used for regular production. Table 4. Capacities, fixed facility opening costs, variable opening cost per unit, and percentage of capacity reserved for disruption Table 5. shipping cost per unit from one city

(1,2,3,4)to another city

(5,6,7,8)Table 6. Demands of the cities

(5,6,7,8)Based on the Data provided in Tables 4, 5, and 6, develop a network optimization model with cost minimization objective and answer the following questions. Before answering the questions, clearly define the variables of your network optimization model. Now, (a) Write down the objective function of this model. [3] (b) Write down the capacity constraints of this model. [2] (c) Write down the demand constraints of this model. [2] (d) Write down the other constraints of this model. [0.5] Control Y, a laptop manufacturing company, produces four models of laptops, i.e., Y1,

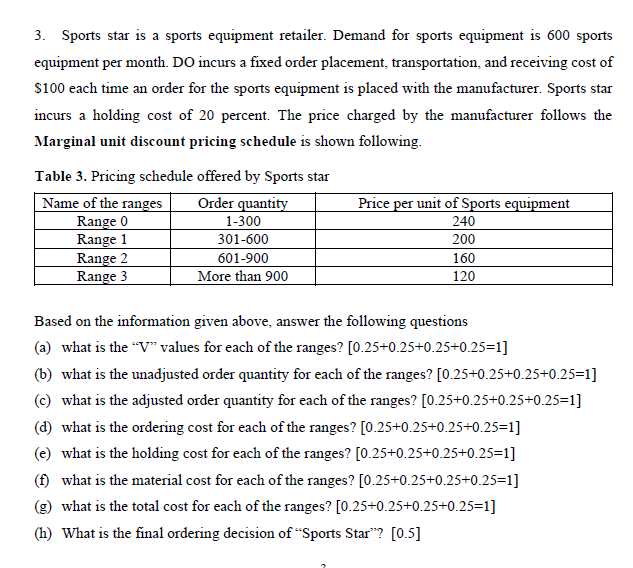

Y2,Y3, and Y4. The demand of these models varies across the customers. Also, from the perspective of cost, they have different product-specific ordering costs. The details are given in Table 2. Across the models, the per unit cost and holding percentage per unit cost remain the same, i.e., Rs. 300 per unit and

20%of per unit cost, respectively. Also, the fixed ordering cost is Rs. 6000 per order (excluding the product specific ordering costs). Control Y maintains a "joint delivery for all the models" policy for all the models. Table 2. Description of annual demand and product-specific ordering costs related to the different models of laptops Based on the information given above, answer the following questions (a) What is the optimal number of orders for Control Y from the perspective of cost minimization? [1.5] (b) what is the cycle inventory of the models