Home /

Expert Answers /

Finance /

a-loss-incurred-by-a-corporation-can-be-carried-back-5-years-and-forward-3-years-must-be-carried-fo-pa424

(Solved): A loss incurred by a corporation can be carried back 5 years and forward 3 years. must be carried fo ...

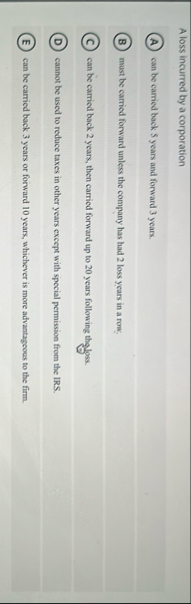

A loss incurred by a corporation can be carried back 5 years and forward 3 years. must be carried forward unless the company has had 2 loss years in a row: can be carried back 2 years, then carried forward up to 20 years following thgloss. cannot be used to reduce taxes in other years except with special permission from the IRS. can be carried back 3 years or forward 10 years, whichever is more advantageous to the firm.