Home /

Expert Answers /

Economics /

a-before-the-tax-is-imposed-the-equilibrium-price-is-and-the-equilibrium-quantity-is-th-pa536

(Solved): a. Before the tax is imposed, the equilibrium price is \( \$ \) and the equilibrium quantity is Th ...

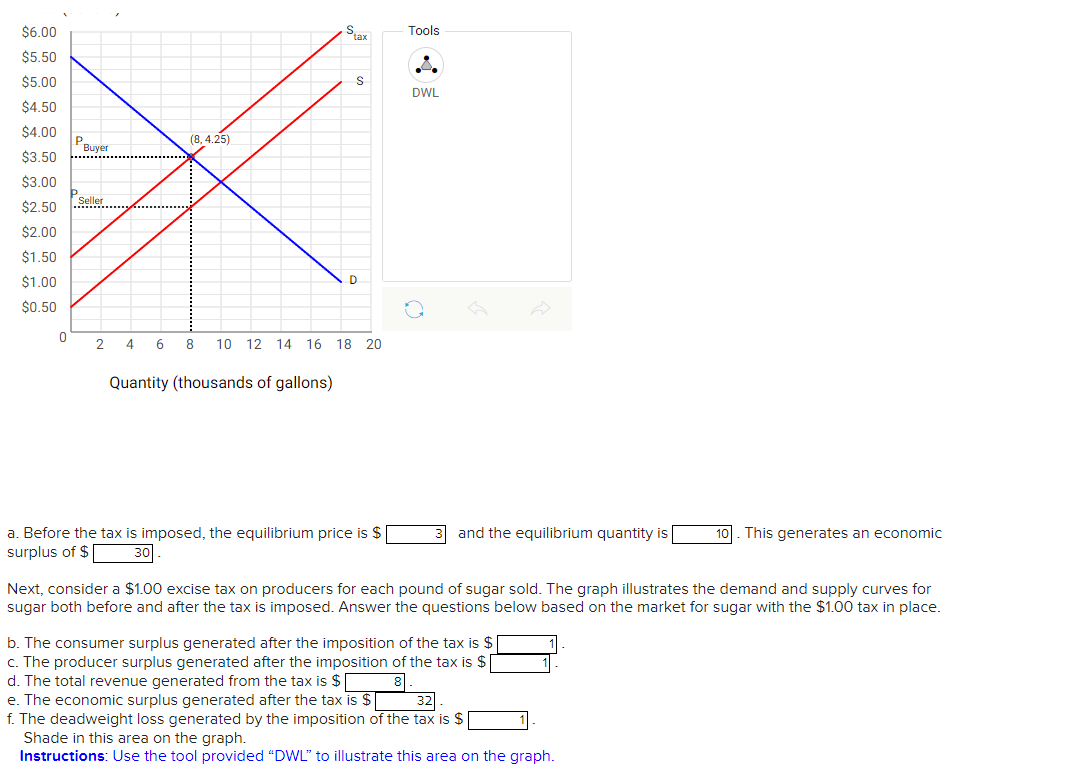

a. Before the tax is imposed, the equilibrium price is \( \$ \) and the equilibrium quantity is This generates an economic surplus of \( \$ \) Next, consider a \( \$ 1.00 \) excise tax on producers for each pound of sugar sold. The graph illustrates the demand and supply curves for sugar both before and after the tax is imposed. Answer the questions below based on the market for sugar with the \( \$ 1.00 \) tax in place. b. The consumer surplus generated after the imposition of the tax is \( \$ \) c. The producer surplus generated after the imposition of the tax is \( \$ \) d. The total revenue generated from the tax is \( \$ \) e. The economic surplus generated after the tax is \$ f. The deadweight loss generated by the imposition of the tax is \( \$ \) Shade in this area on the graph. Instructions: Use the tool provided "DWL" to illustrate this area on the graph.

Expert Answer

a. Before tax equilibrium arises when demand and supply are equal. Equilibrium price= 3 Equilibrium quantity= 10 As tax imposed the supply curve shifts to left as Stax. Now the pri