(Solved): a. A securities market consists of the three securities A, B and C with the following features: \tab ...

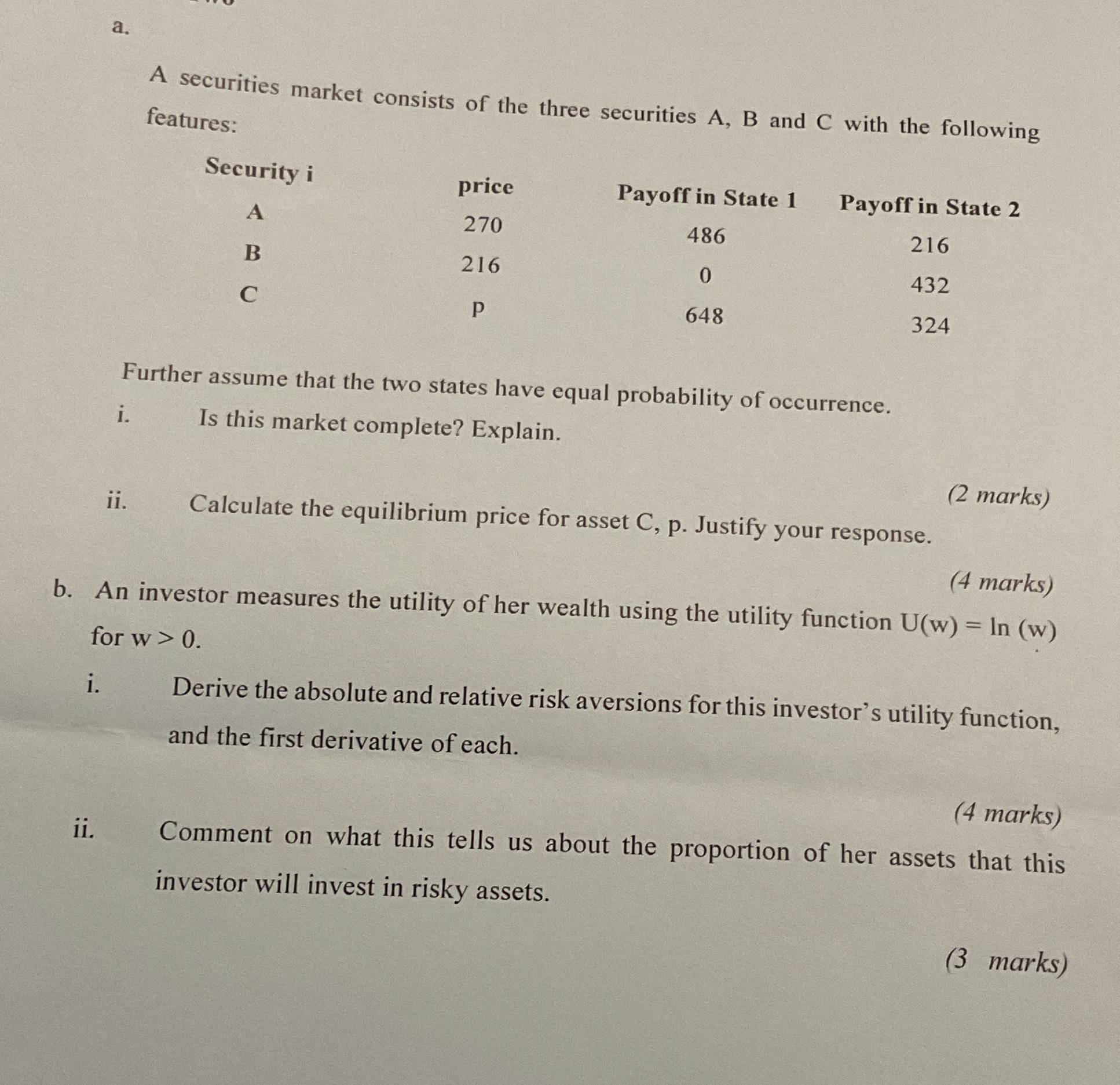

a. A securities market consists of the three securities A, B and C with the following features: \table[[Security i,price,Payoff in State 1,Payoff in State 2],[A,270,486,216],[B,216,0,432],[C,p,648,324]] Further assume that the two states have equal probability of occurrence. i. Is this market complete? Explain. ii. Calculate the equilibrium price for asset C, p. Justify your response. (2 marks) (4 marks) b. An investor measures the utility of her wealth using the utility function

U(w)=ln(w)for

w>0. i. Derive the absolute and relative risk aversions for this investor's utility function, and the first derivative of each. (4 marks) ii. Comment on what this tells us about the proportion of her assets that this investor will invest in risky assets. (3 marks)