Home /

Expert Answers /

Finance /

9-modified-internal-rate-of-return-mirr-the-irr-evaluation-method-assumes-that-cash-flows-from-t-pa259

(Solved): 9. Modified internal rate of return (MIRR) The IRR evaluation method assumes that cash flows from t ...

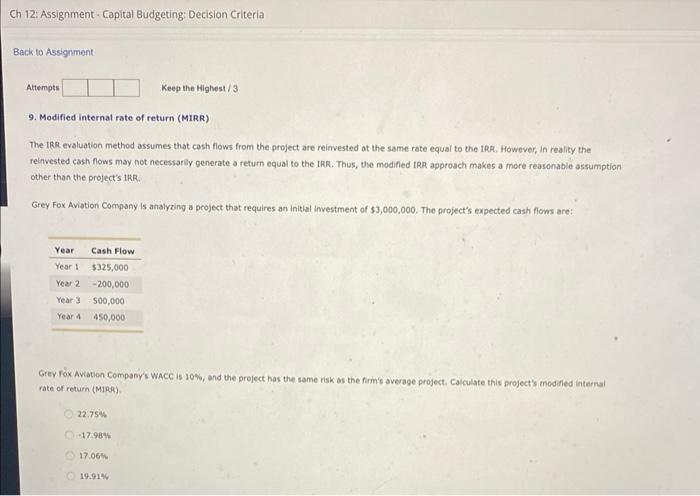

9. Modified internal rate of return (MIRR) The IRR evaluation method assumes that cash flows from the project are reinvested ot the same rate equal to the IRA. However, in reality the reinvested cash flows may not necessarily generate a return equal to the IRR. Thus, the modified IRR approsch makes a more reasonable assumption other than the project's IRR. Grey Fox Aviation Company is analyzing a project that requires an initial investment of \( \$ 3,000,000 \). The project's expected cash flows are: Grey Fox Aviation Company's WaCC is 10\%, and the project has the same risk as the fim's average project. Calculate this projects modified internal rate of return (M1BR). \[ 22.75 \% \] \( -17.984 \) \( 17,06 \% \) \( 19.914 \)

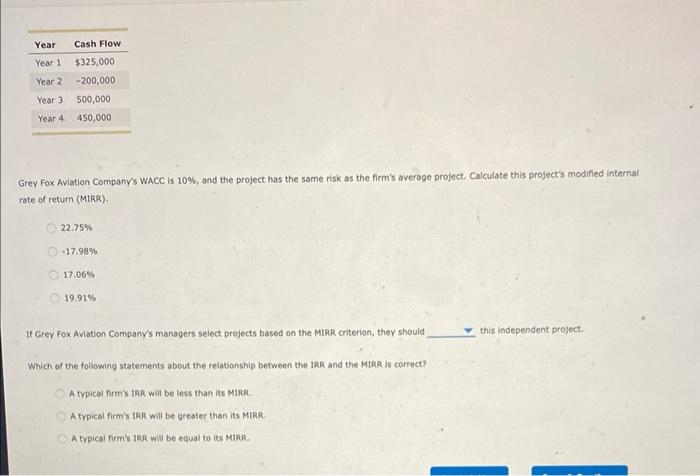

Grey Fox Aviation Company's WACC is \( 10 \% \), and the project has the same risk as the firm's average project. Calculate this project's modified internal rate of return (MIRR). \( 22.75 \% \) \( -17.98 \% \) \( 17.06 \% \) \( 19.91 \% \) If Grey Fox Aviation Company's managers select projects based on the MIRR criterion, they should this independent project. Which of the foliowing statements about the relationship between the IRR and the MIRR is correct? A trpical firm's the will be loss than its MiRR. A typical firm's IRR will be greater than its MiRR. A typical firm's tra will be equal to its Misk.