Home /

Expert Answers /

Finance /

9-effects-of-portfolio-size-on-portfolio-risk-the-following-graph-plots-portfolio-risk-against-the-pa591

(Solved): 9. Effects of portfolio size on portfolio risk The following graph plots portfolio risk against the ...

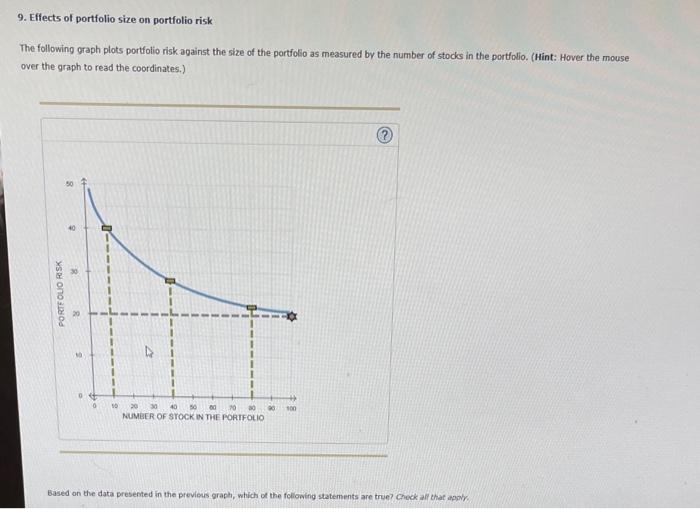

9. Effects of portfolio size on portfolio risk The following graph plots portfolio risk against the size of the portfolio as measured by the number of stocks in the portfolio. (Hint: Hover the mouse over the graph to read the coordinates.) Based on the data presented in the previous graph, which of the following statements are true? Check all ehat apory.

Based on the data presented in the previous graph, which of the following statements are true? check all that apply. A portfolio of 80 or more stocks could eliminate almost half of the risk. A portfolio of 40 stocks has a diversifiable risk of \( 8 \% \). As the portfolio's size increases, its market risk decreases. The market portfolio would have a standard deviation of \( 20 \% \). The market portfolio would have a standard deviation of about \( 40 \% \). The benchmark for a well-diversified stock portfolio is the market portfolio, which is a portfollo containing all stocks, The relevant risk of an individual stock is measured by its beta coefficient, which is defined under the Capital Asset Pricing Model (CAPM) as the amount of risk that the stock contributes to the well-diversified portfolio, Based on your understanding of the CAPM and beta, answer the following question: Which of the following statements about stock's correlation with the market is true? A stock with a high correlation with the market is risky. A stock with a low correlation with the market is risky. A stock with low stand alone risk will tend to destabilze the portfolio.