(Solved): 7. Short-run supply and long-run equilibrium Consider the competitive market for ruthenium. Assume ...

7. Short-run supply and long-run equilibrium

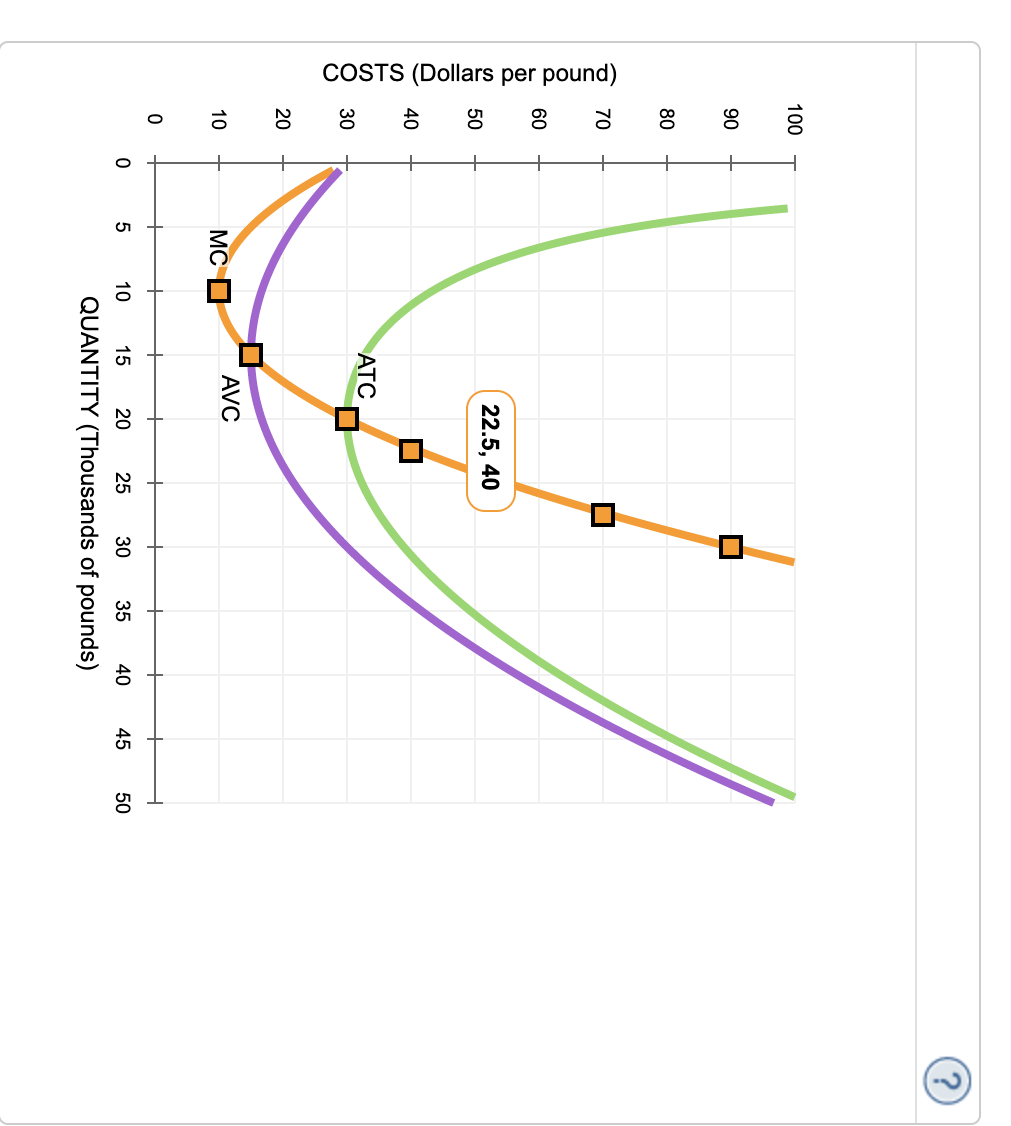

Consider the competitive market for ruthenium. Assume that no matter how many firms operate in the industry, every firm is identical and faces the same marginal cost (MC), average total cost (ATC), and average variable cost (AVC) curves plotted in the following graph.

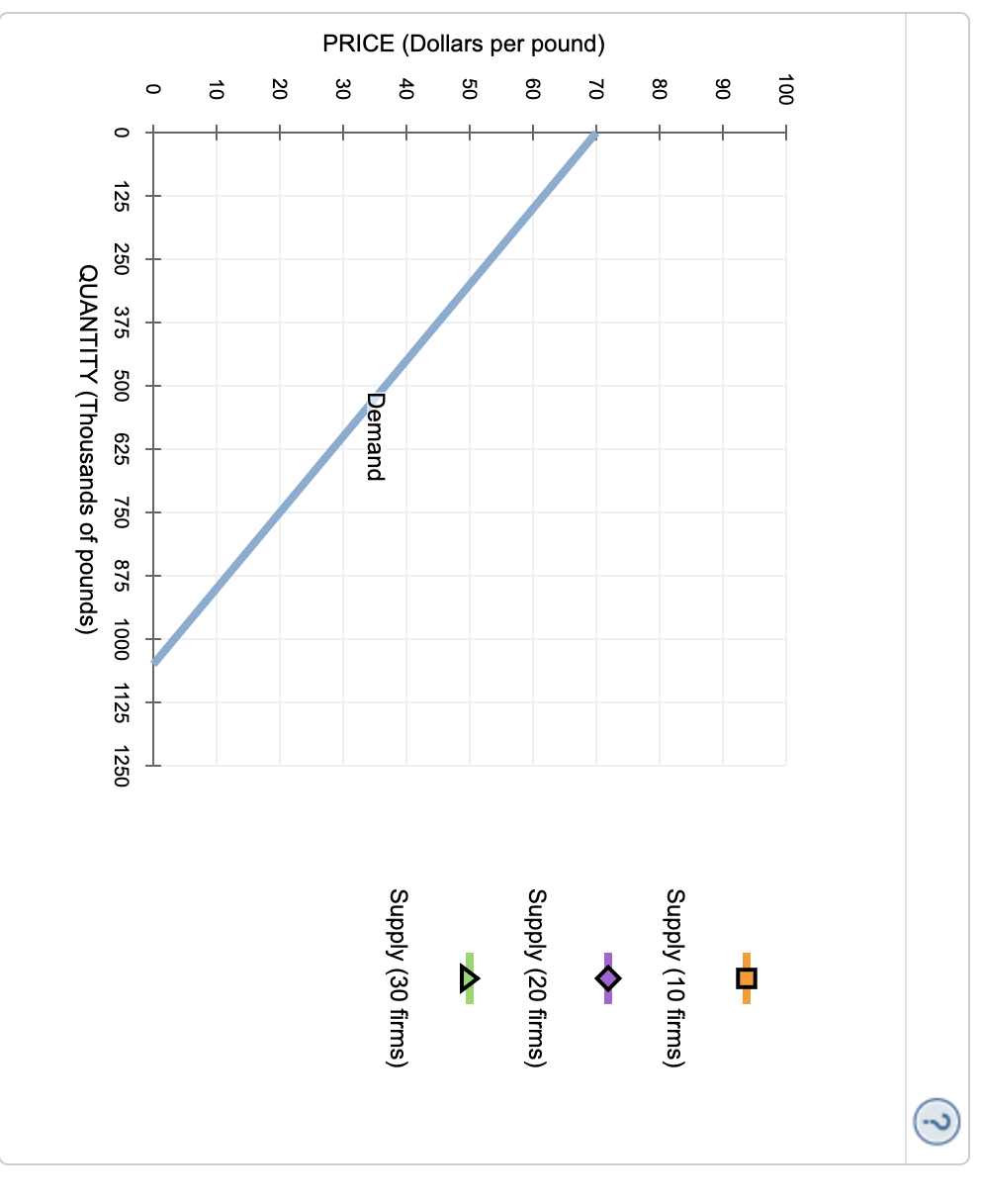

The following graph plots the market demand curve for ruthenium.

Use the orange points (square symbol) to plot the initial short-run industry supply curve when there are 10 firms in the market. (Hint: You can disregard the portion of the supply curve that corresponds to prices where there is no output since this is the industry supply curve.) Next, use the purple points (diamond symbol) to plot the short-run industry supply curve when there are 20 firms. Finally, use the green points (triangle symbol) to plot the short-run industry supply curve when there are 30 firms.

If there were 20 firms in this market, the short-run equilibrium price of ruthenium would be $______per pound. At that price, firms in this industry would ______(options are: earn zero profit, shut down, earn a positive profit, operate at a loss). Therefore, in the long run, firms would________(options are: enter, exit, neither) the ruthenium market.

Because you know that competitive firms earn _________ (options are:negative, positive, zero) economic profit in the long run, you know the long-run equilibrium price must be $________ per pound. From the graph, you can see that this means there will be_______(options are:10,20,30) firms operating in the ruthenium industry in long-run equilibrium.

True or False: Assuming implicit costs are positive, each of the firms operating in this industry in the long run earns positive accounting profit.

True

False

Expert Answer

0.44 Earn Enter False Explanation: Supply curve is represented by the upward sloping region of MC curve above the minimum AVC . If there were 10 firms