(Solved): 5-30 ABC, costs of quality. G. Watson) Stanford Industries currently uses a normal job-costing syste ...

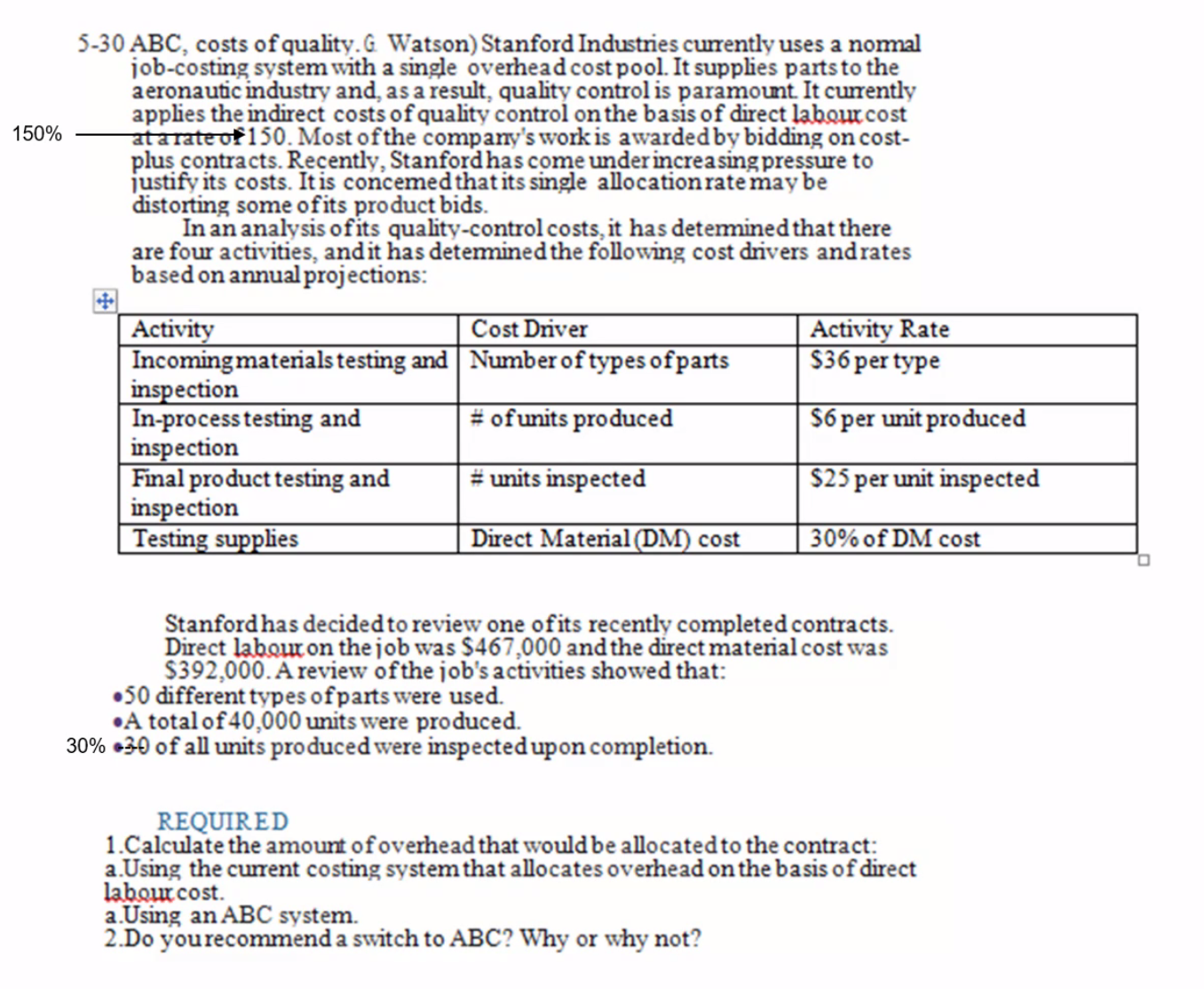

5-30 ABC, costs of quality. G. Watson) Stanford Industries currently uses a normal job-costing system with a single overhead cost pool. It supplies parts to the aeronautic industry and, as a result, quality control is paramount It currently applies the indirect costs of quality control on the basis of direct laboux cost 150\% atarate of 150 . Most of the company's work is awarded by bidding on costplus contracts. Recently, Stanford has come under increasing pressure to pustify its costs. It is concemed that its single allocation rate may be distorting some of its product bids. In an analysis of its quality-control costs, it has determined that there are four activities, and it has determined the following cost drivers and rates based on annual projections: \begin{tabular}{|l|l|l|} \hline Activity & Cost Driver & Activity Rate \\ \hline \begin{tabular}{l} Incomingmaterials testing and \\ inspection \end{tabular} & Number of types of parts & \$36 per type \\ \hline \begin{tabular}{l} In-process testing and \\ inspection \end{tabular} & \# of units produced & \$6 per unit produced \\ \hline \begin{tabular}{l} Final product testing and \\ inspection \end{tabular} & \# units inspected & \$25 per unit inspected \\ \hline Testing supplies & Direct Material(DM) cost & \( 30 \% \) of DM cost \\ \hline \end{tabular} Stanford has decided to review one of its recently completed contracts. Direct laboux on the job was \( \$ 467,000 \) and the direct material cost was \( \$ 392,000 \). A review of the job's activities showed that: - 50 different types of parts were used. - A total of 40,000 units were produced. \( 30 \% \cdot 30 \) of all units produced were inspected upon completion. REQUIRED 1.Calculate the amount of overhead that would be allocated to the contract: a.Using the current costing system that allocates overhead on the basis of direct labour cost. a.Using an \( A B C \) system. 2.Do yourecommend a switch to ABC ? Why or why not?