Home /

Expert Answers /

Economics /

4-understanding-different-policy-options-to-correct-for-negativeexternalities-carbon-dioxide-emiss-pa136

(Solved): 4. Understanding different policy options to correct for negativeexternalities Carbon dioxide emiss ...

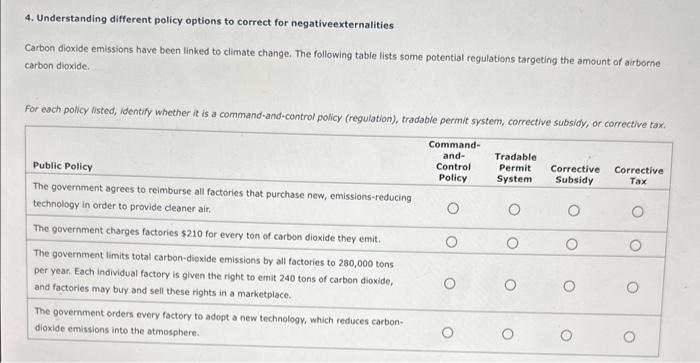

4. Understanding different policy options to correct for negativeexternalities Carbon dioxide emissions have been linked to climate change. The following table lists some potential regulations targeting the amount of airborne carbon dioxide. For each pollcy listed, identify whether it is a command-and-control policy (regulation), tradable permit system, corrective subsidy, or corrective tax.

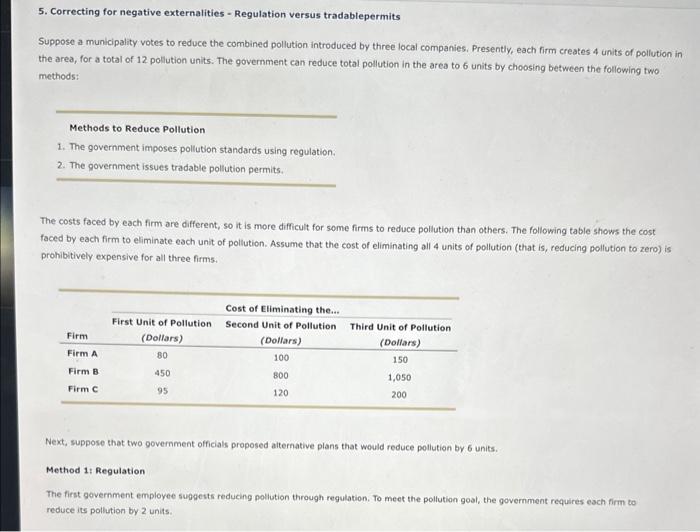

5. Correcting for negative externalities - Regulation versus tradablepermits Suppose a municipality votes to reduce the combined pollution introduced by three local companies. Presently, each firm creates 4 units of pollution in the area, for a total of 12 pollution units. The government can reduce total pollution in the area to 6 units by choosing between the following two methods: Methods to Reduce Pollution 1. The government imposes pollution standards using regulation. 2. The government issues tradable pollution permits. The costs faced by each firm are different, so it is more difficult for some firms to reduce pollution than others. The following table shows the cost faced by each firm to eliminate each unit of pollution. Assume that the cost of eliminating all 4 units of pollution (that is, reducing pollution to zero) is prohibitively expensive for all three firms. Next, suppose that two government officials proposed alternative plans that would reduce pollution by 6 units. Method 1: Regulation The first government employee suggests reducing pollution through regulation. To meet the pollution goal, the government requires each firm to reduce its pollution by 2 units.

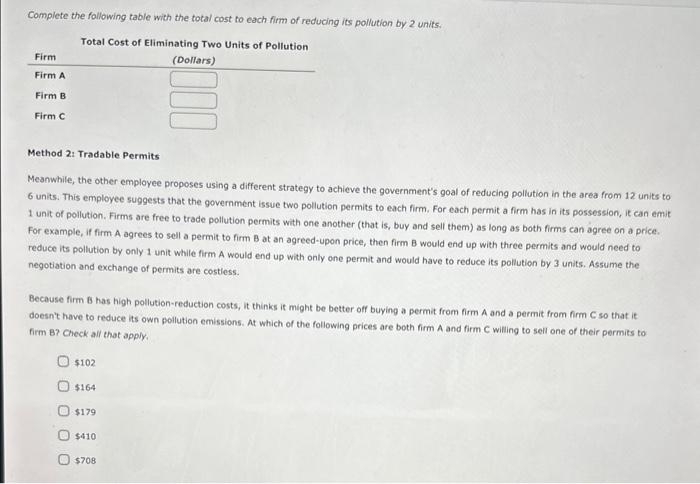

Complete the following table with the total cost to each firm of reducing its pollution by 2 units. Method 2: Tradable Permits Meanwhile, the other employee proposes using a different strategy to achieve the government's goal of reducing pollution in the area from 12 units to 6 units. This employee suggests that the government issue two poliution permits to each firm. For each permit a firm has in its possession, it can emit 1 unit of pollution. Firms are free to trade pollution permits with one another (that is, buy and sell them) as long as both firms can agree on a price. For example, if firm A agrees to sell a permit to firm B at an agreed-upon price, then firm B would end up with three permits and would need to reduce its pollution by only 1 unit while firm A would end up with only one permit and would have to reduce its pollution by 3 units. Assume the negotiation and exchange of permits are costiess. Because firm 6 has high pollution-reduction costs, it thinks if might be better off buying a permit from firm A and a permit from firm \( \mathrm{C} \) so that it? doesn't have to reduce its own pollution emissions. At which of the following prices are both firm \( A \) and firm \( C \) willing to sell one of their permits to firm B? Check all that apply. 5102 \( \$ 164 \) \( \$ 179 \) \( \$ 410 \) \( \$ 708 \)

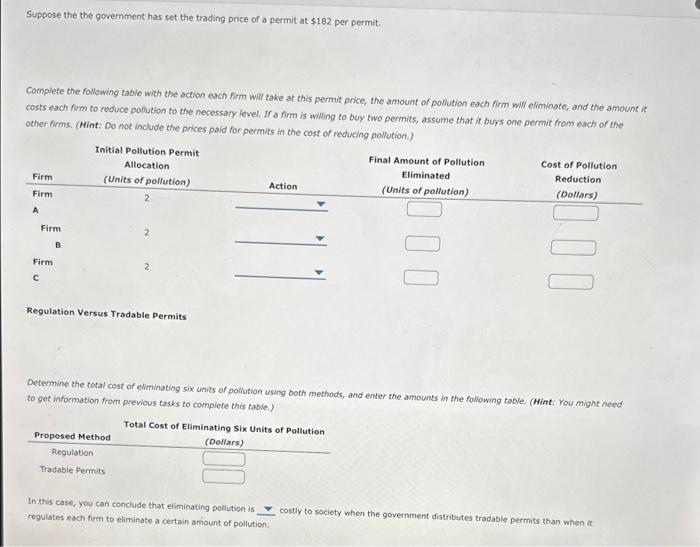

Suppose the the government has set the trading price of a permit at \( \$ 182 \) per permit. Complete the following table with the action each firm will take at this permit price, the amount of pollution each firm will eliminate, and the amount it costs each firm to reduce pollution to the necessary level. If a firm is willing to buy two permits, assume that it buys one permit from each of the other firms. (Hint: Do not include the prices pald for permits in the cost of reducing pollution.) Regulation Versus Tradable Permits Determine the total cost of eliminating six units of pallution using both methods, and enter the amounts in the following table. (Hint: rou might neted to get information from previous tosks to complete this table.) In this case, you can conciude that eliminating pollution is costly to society when the government distributes tradable permits than when it regulates each firm to eliminate a certain amount of poilution.

6. Achieving lower pollution Suppose a politician is critical of a government pollution permit policy that they say allows companies to buy and sell the right to pollute. They argue that the public's right to breathe clean air and the health of the planet require real regulation instead of this type of government policy. Which of the following arguments best describes why the majority of economists would disagree with their statement? The environment is so important that it should be protected as much as possible, regardless of the cost. Tradable pollution permits in a free market is typically more efficient than government regulation. A corrective tax would result in a more efficient outcome than either tradable permits or government regulation would. Clean air is a fundamental right, and government regulation will allow too much pollution.

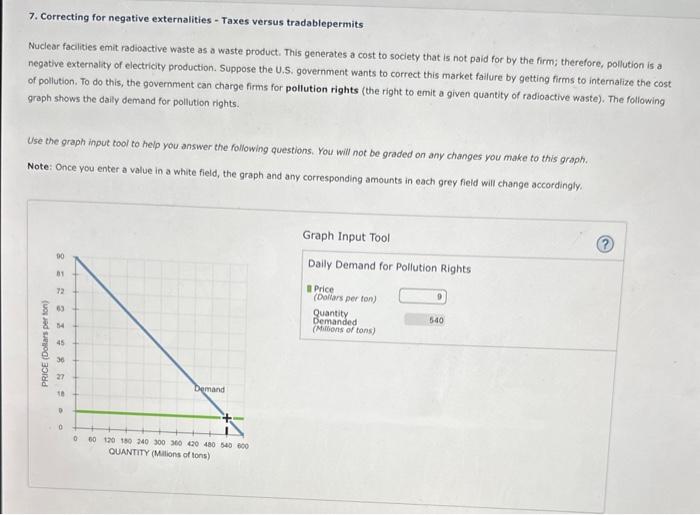

7. Correcting for negative externalities - Taxes versus tradablepermits Nuclear facilities emit radioactive waste as a waste product. This generates a cost to society that is not paid for by the firm; therefore, pollution is a negative externality of electricity production. Suppose the U.S. government wants to correct this market failure by getting firms to internalize the cost of pollution. To do this, the government can charge firms for pollution rights (the right to emit a given quantity of radioactive waste). The following graph shows the daily demand for pollution rights. Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph. Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly, Graph Input Tool Daily Demand for Pollution Rights

Suppose the government has determined that the socially optimal quantity of radioactive waste is 360 milion tons per day. One way govemments can charge firms for pollution rights is by imposing a per-unit tax on emissions. A tax (or price in this case) of of radioactive waste emitted will achieve the desired level of pollution. Now suppose the U.S. government does not know the demand curve for pollution and, therefore, cannot determine the optimal tax to achieve the detired level of pollution. Instead, it auctions off tradable pollution permits. Each permit entities its owner to emit one ton of radioactive waste per day. To achieve the socially optimal quantity of pollution, the government auctions off 360 milition pollution permits. Given this quantity of permits, the price for each permit in the market for pollution rights will be The previous analysis hinges on the government having good information regarding either the demand for pollution permits or the optimal level of pollution (or both). Given that the appropriate policy (tradable permits or corrective taxes) can depend on the avaliable information and the policy goal, consider the following scenario. An environmental study conducted in a particular city suggests that if a chemical plant emats more than 110 miliion tons of chemicals each year, the water supply will become contaminated beyond the point where fitration techniques can make it safe for drinking. If this is all the information the government has, which solution to reduce pollution is appropriate? Check all that apply. Corrective taxes Tradable permits

Expert Answer

1) Corrective subsidy- The government providing reimbursements to factories for purchasing new emission reducing technology would fall under this cate