Home /

Expert Answers /

Economics /

4-conditions-for-price-discrimination-price-discrimination-is-the-practice-of-charging-different-p-pa461

(Solved): 4. Conditions for price discrimination Price discrimination is the practice of charging different p ...

4. Conditions for price discrimination Price discrimination is the practice of charging different prices for the same product that are not justified by cost differences. Evaluate the following statement: "Price discrimination is not possible when a good is sold in a perfectly competitive market." False, because perfectly competitive firms do not profit maximize by setting marginal revenue equal to marginal cost False, because perfectly competitive firms have market power None of these choices True, because perfectly cpmpetitive firms have no market power

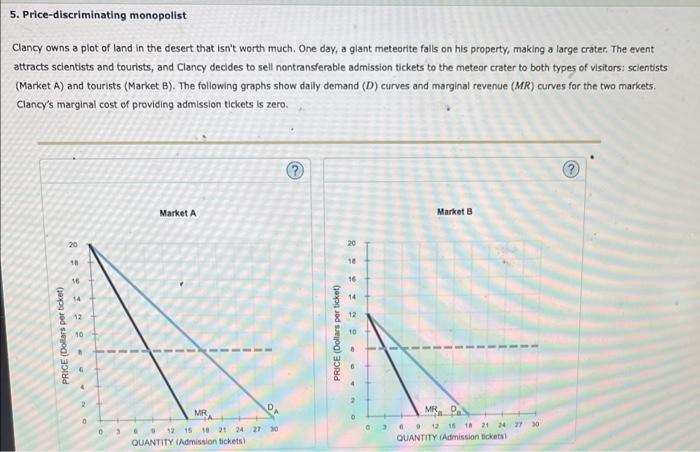

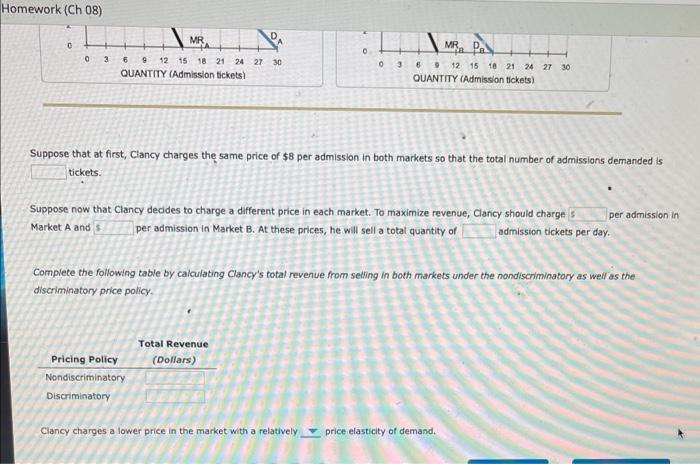

5. Price-discriminating monopolist Clancy owns a plot of land in the desert that isn't worth much. One day, a glant meteorite falls on his property, making a large crater. The event attracts scientists and tourists, and Clancy decides to sell nontransferable admission tickets to the meteor crater to both types of visitors: scientists (Market A) and tourists (Market B). The following graphs show daily demand \( (D) \) curves and marginal revenue (MR) curves for the two markets. Clancy's marginal cost of providing admission tickets is zero.

Suppose that at first, Clancy charges the same price of \( \$ 8 \) per admission in both markets so that the total number of admissions demanded is tickets. Suppose now that Clancy deddes to charge a different price in each market. To maximize revenue, Clancy should charge per admission in Market \( A \) and per admission in Market B. At these prices, he will sell a total quantity of admission tickets per day. Complete the following table by calculating Clancy's total revenue from selling in both markets under the nondiscriminatory as well as the discriminatory price policy. Clancy charges a lower price in the market with a relatively price elasticity of demand.

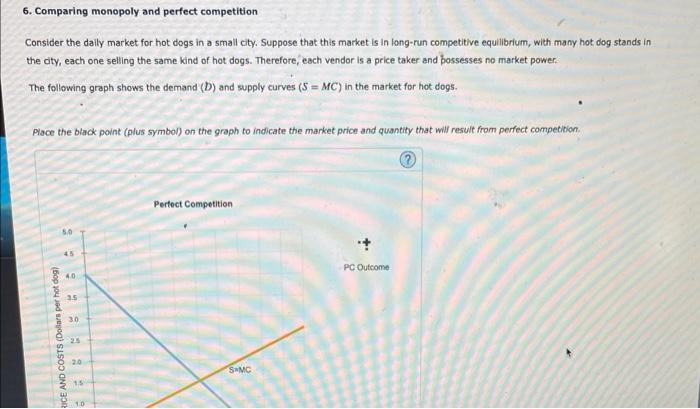

6. Comparing monopoly and perfect competition Consider the daily market for hot dogs in a small city. Suppose that this market is in long-run competitive equilibrium, with many hot dog stands in the diy, each one selling the same kind of hot dogs. Therefore, each vendor is a price taker and possesses no market power. The following graph shows the demand \( (D) \) and supply curves \( (S=M C) \) in the market for hot dogs. Place the black point (plus symbol) on the graph to indicate the market price and quantity that will result from perfect competilion.

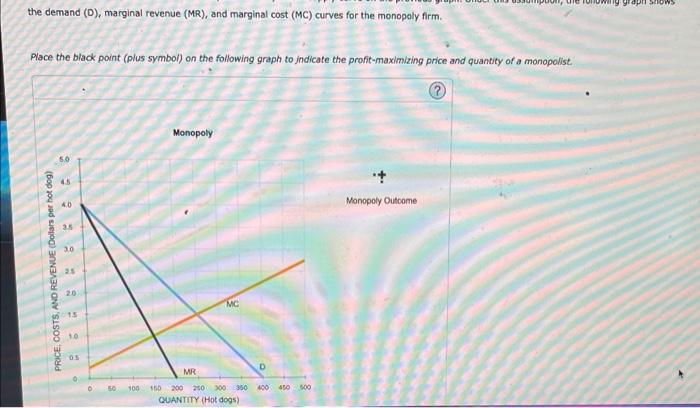

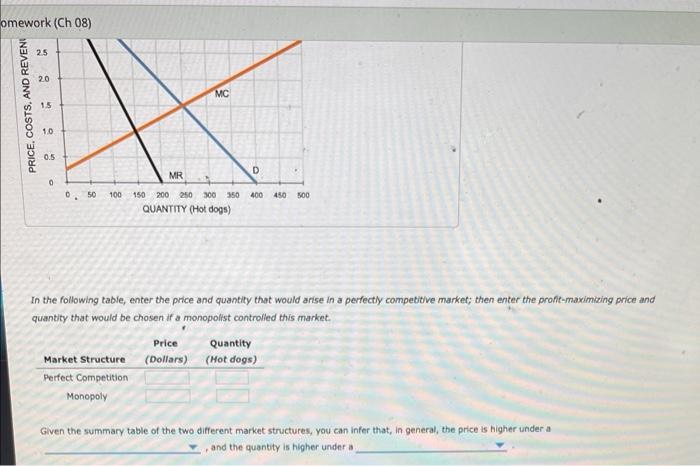

the demand (D), marginal revenue (MR), and marginal cost (MC) curves for the monopoly firm. Place the black point (plus symbol) on the following graph to jndicate the profit-maximizing price and quantity of a monopolist.

In the following table, enter the price and quantity that would arise in a perfectly competitive market; then enter the profit-maximizing price and quantity that would be chosen if a monopolist controlied this market. Given the summary table of the two different market structures, you can infer that, in general, the price is higher under a and the quantity is higher under a

Expert Answer

Price Discrimination refers to dif