Home /

Expert Answers /

Finance /

2-and-4-please-ken-young-and-kim-sherwood-organized-reader-direct-as-a-corporation-each-contribute-pa313

(Solved): 2 and 4 please Ken Young and Kim Sherwood organized Reader Direct as a corporation, each contribute ...

2 and 4 please

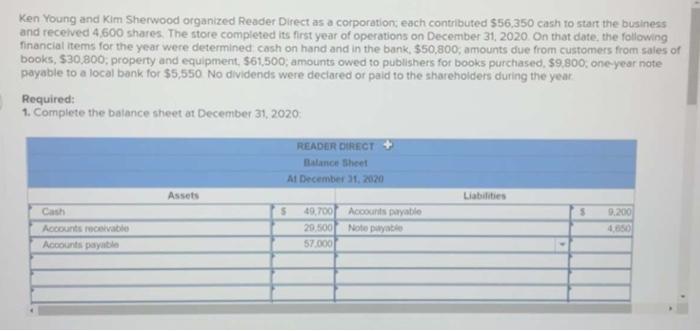

Ken Young and Kim Sherwood organized Reader Direct as a corporation, each contributed \( \$ 56,350 \) cash to start the business and recelved \( 4.600 \) shares. The store completed its first year of operations on December 31,2020 . On that date, the following financial items for the year were determinec cosh on hand and in the bank, \( \$ 50,800 \), amounts due from customers from saies of books, \( \$ 30,800 \); property and equipment, \( \$ 61,500 \); amounts owed to publishers for books purchased, \( \$ 9,800 \), one-year note payable to a local bank for \( \$ 5,550 \) No dividends were deciared or paid to the shareholders during the year Required: 1. Complete the balance sheet at December 31, 2020:

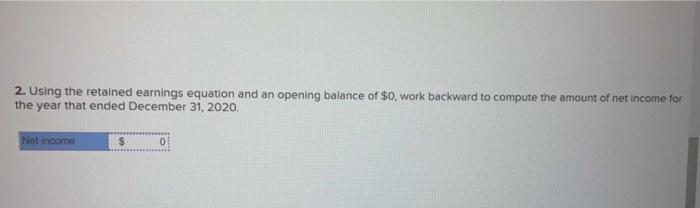

2. Using the retained earnings equation and an opening balance of \( \$ 0 \), work backward to compute the amount of net income for the year that ended December 31, 2020.

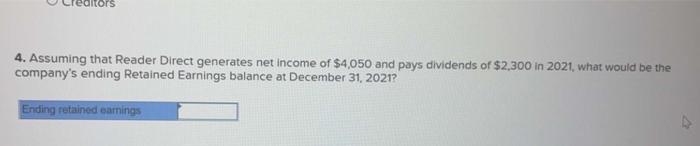

4. Assuming that Reader Direct generates net income of \( \$ 4,050 \) and pays dividends of \( \$ 2,300 \) in 2021 , what would be the company's ending Retained Earnings balance at December 31, 2021?

Expert Answer

According to the given question, we are required to prepare the Balance Sheet, and compute the net income & retained earnings. We can solve this quest