Home /

Expert Answers /

Economics /

10-understanding-marginal-and-average-tax-rates-using-the-information-provided-on-the-incene-tax-s-pa929

(Solved): 10. Understanding marginal and average tax rates Using the information provided on the incene tax s ...

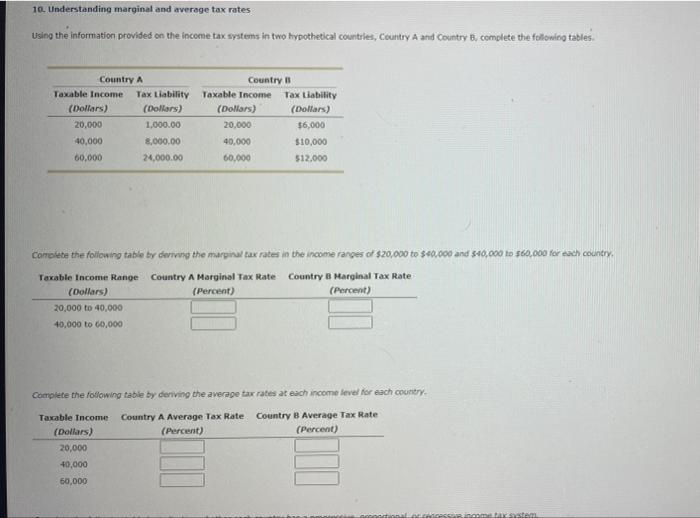

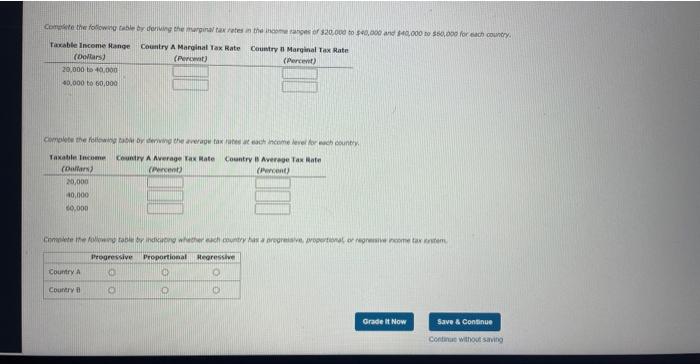

10. Understanding marginal and average tax rates Using the information provided on the incene tax systems in two hyoothetical countries, Country a and Country B, complete the following tables. Condiete the following tabse by dwirwy the marginal tax rates in the income ranges of \( \$ 20,000 \) to \( \$ 40,000 \) and 340,000 to sto, 000 for each codntry. Complete the folowing table by deriving the average tax rates at each income level for each couitior.

Saye kensinus

Expert Answer

(Part 1) Marginal tax rate (MTR) = Change in Tax liability (TL) / Change in Taxable income (TI) TI ($) Country A Country B 20,000 to 40,000 (8,000 - 1,000) / (40,000 -