Home /

Expert Answers /

Accounting /

1-what-is-the-cash-from-operations-in-2026-when-running-the-base-case-driver-pa874

(Solved): 1) What is the Cash From Operations in 2026 when running the Base Case Driver ...

1) What is the Cash From Operations in 2026 when running the Base Case Drivers?

a) 19.128 million

b) (79.000) million

c) 23.244 million

d) 18.942 million

Dashboard: Charts \& Graphs All figures in USD thousands uniess stoted Driver Swritch INCOME STATEMENT Revenue EBITDA EBITDA Margin Net Income Net income Margin CASH FLOW STATEMENT Operating Investing Financing Change in Cash CASH FLOW STATEMENT INCOME STATEMENT \begin{tabular}{ccccccccc} \( - \) & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) \\ \( - \) & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) \\ \( - \) & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) \\ \hline\( - \) & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) \end{tabular} Case Study A Page 2 of 16 \( 001 \mathrm{CFI} \)

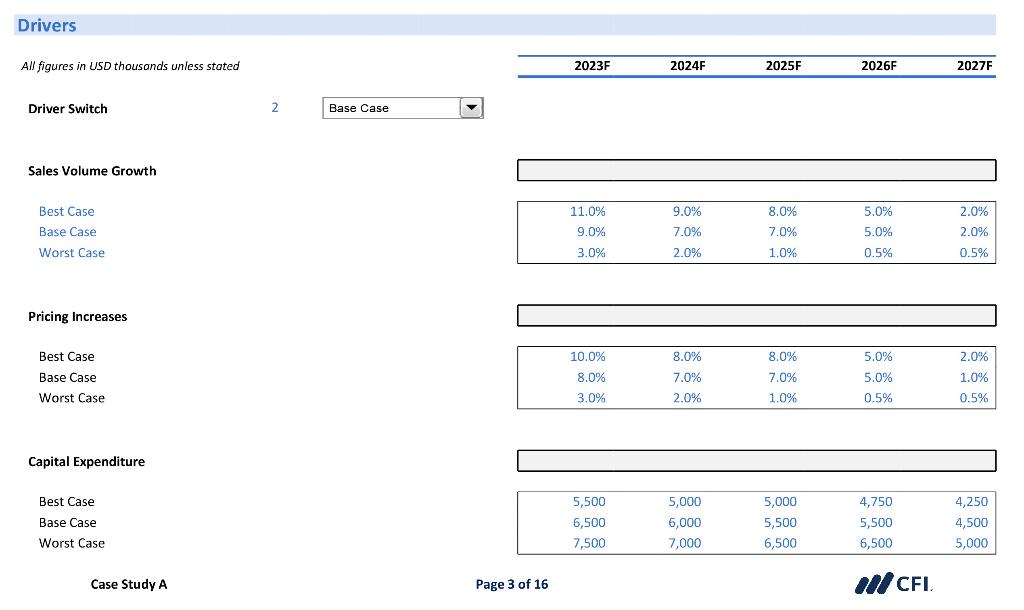

Drivers All figures in USD thousands unless stated \begin{tabular}{lllll} \hline \( 2023 F \) & \( 2024 F \) & \( 2025 F \) & \( 2026 F \) & \( 2027 F \) \\ \hline \end{tabular} Driver Switch \( 2 \quad \) Base Case Sales Volume Growth Best Case Base Case Worst Case \begin{tabular}{|rrrrr|} \hline \( 11.0 \% \) & \( 9.0 \% \) & \( 8.0 \% \) & \( 5.0 \% \) & \( 2.0 \% \) \\ \( 9.0 \% \) & \( 7.0 \% \) & \( 7.0 \% \) & \( 5.0 \% \) & \( 2.0 \% \) \\ \( 3.0 \% \) & \( 2.0 \% \) & \( 1.0 \% \) & \( 0.5 \% \) & \( 0.5 \% \) \\ \hline \end{tabular} Pricing Increases Best Case Base Case Worst Case \begin{tabular}{|rrrrr|} \hline \( 10.0 \% \) & \( 8.0 \% \) & \( 8.0 \% \) & \( 5.0 \% \) & \( 2.0 \% \) \\ \( 8.0 \% \) & \( 7.0 \% \) & \( 7.0 \% \) & \( 5.0 \% \) & \( 1.0 \% \) \\ \( 3.0 \% \) & \( 2.0 \% \) & \( 1.0 \% \) & \( 0.5 \% \) & \( 0.5 \% \) \\ \hline \end{tabular} Capital Expenditure Best Case Base Case Worst Case \begin{tabular}{|lllll|} \hline 5,500 & 5,000 & 5,000 & 4,750 & 4,250 \\ 6,500 & 6,000 & 5,500 & 5,500 & 4,500 \\ 7,500 & 7,000 & 6,500 & 6,500 & 5,000 \\ \hline \end{tabular} Case Study A Page 3 of 16 Al CFI.

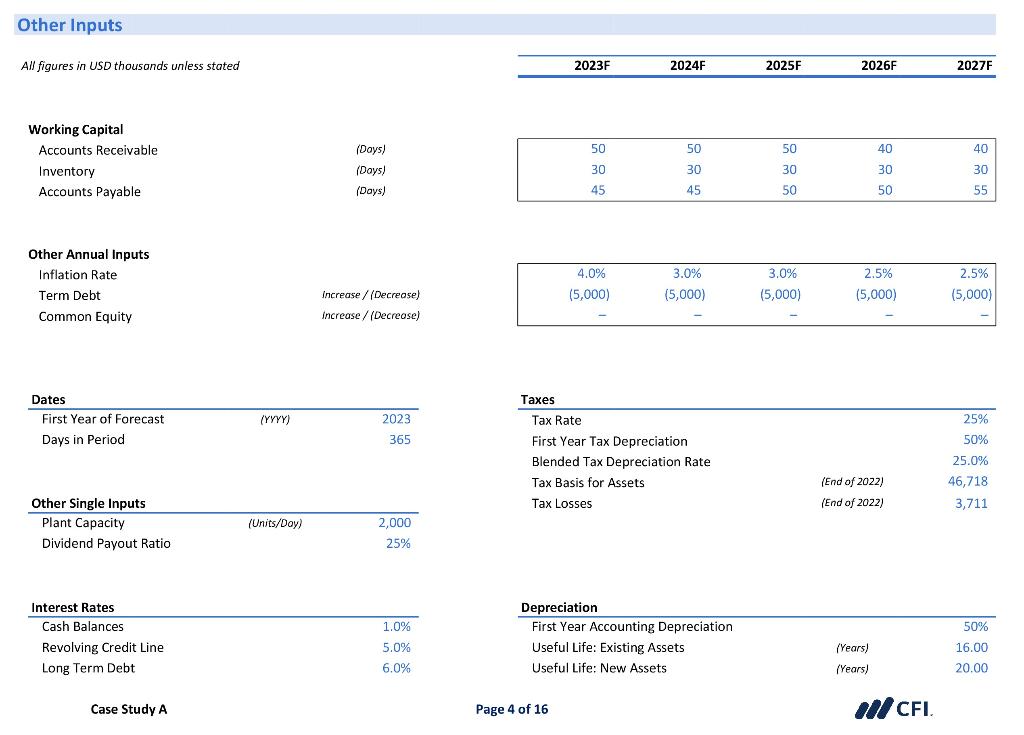

Allf W Ot 1 7 (

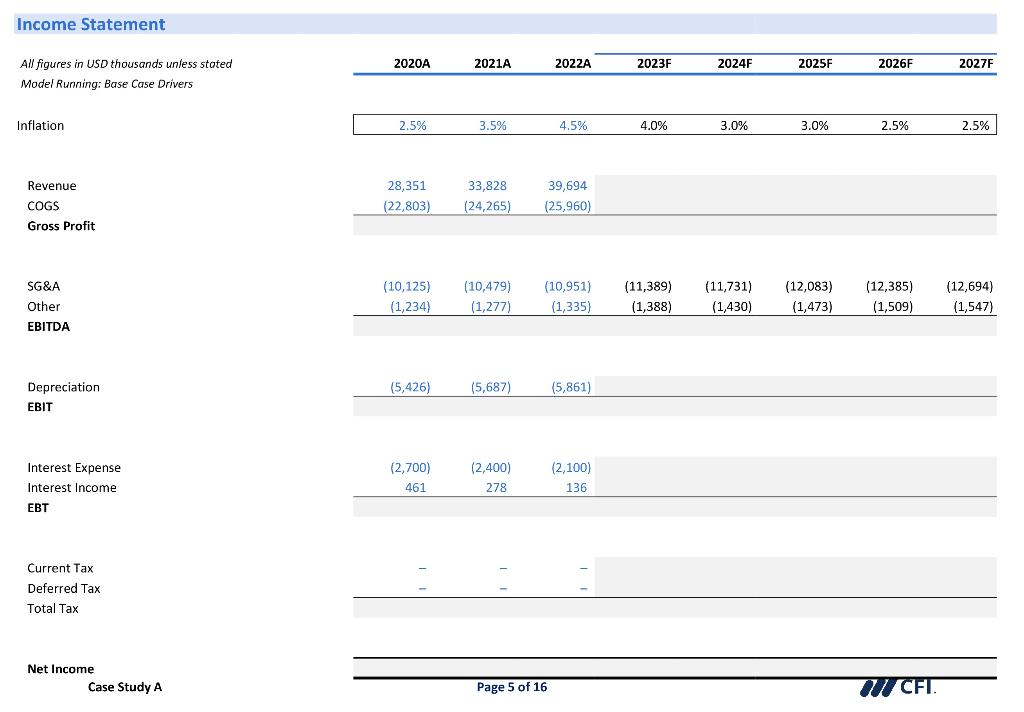

Income Statement All figures in USD thousands unless stated Model Running: Base Case Drivers Inflation \begin{tabular}{|llllllll|} \hline \( 2.5 \% \) & \( 3.5 \% \) & \( 4.5 \% \) & \( 4.0 \% \) & \( 3.0 \% \) & \( 3.0 \% \) & \( 2.5 \% \) & \( 2.5 \% \) \\ \hline \end{tabular} Revenue COGS Gross Profit \begin{tabular}{ccc} 28,351 & 33,828 & 39,694 \\ \( (22,803) \) & \( (24,265) \) & \( (25,960) \) \\ \hline \end{tabular} SG\&A Other EBITDA \begin{tabular}{rrrrrrrr} \( (10,125) \) & \( (10,479) \) & \( (10,951) \) & \( (11,389) \) & \( (11,731) \) & \( (12,083) \) & \( (12,385) \) & \( (12,694) \) \\ \( (1,234) \) & \( (1,277) \) & \( (1,335) \) & \( (1,388) \) & \( (1,430) \) & \( (1,473) \) & \( (1,509) \) & \( (1,547) \) \\ \hline \end{tabular} Depreciation \( \begin{array}{lll}(5,426) & (5,687) & (5,861)\end{array} \) EBIT Interest Expense Interest Income \begin{tabular}{ccc} \( (2,700) \) & \( (2,400) \) & \( (2,100) \) \\ 461 & 278 & 136 \\ \hline \end{tabular} EBT Current Tax Deferred Tax Total Tax Net Income Case Study A Page 5 of 16

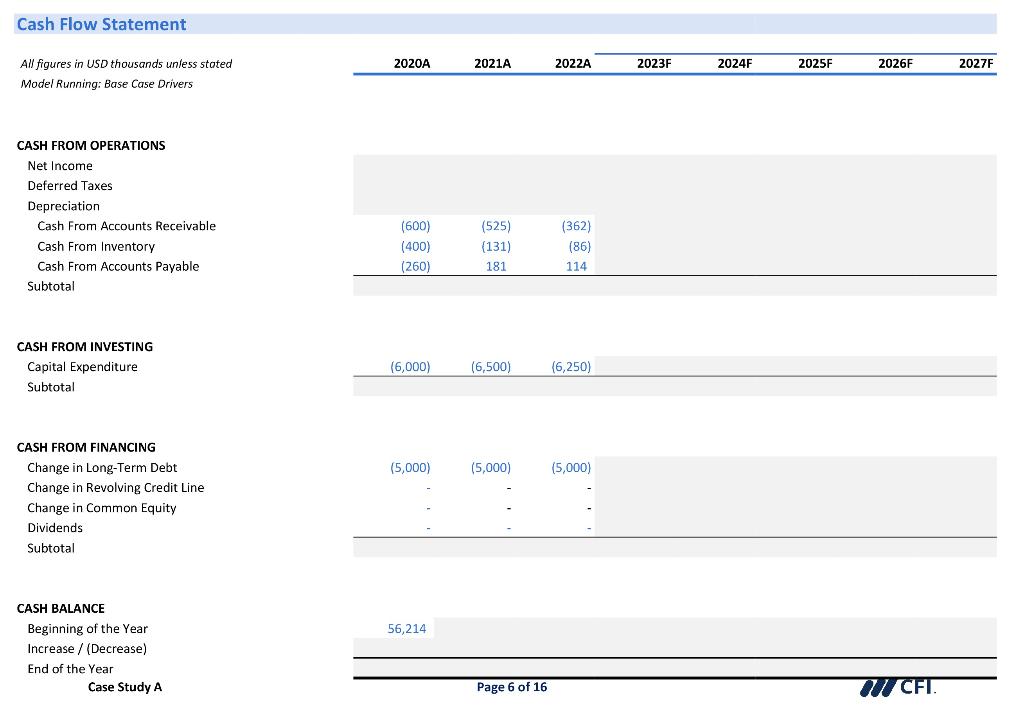

Cash Flow Statement All figures in USD thousands unless stated Model Running: Base Case Drivers CASH FROM OPERATIONS Net income Deferred Taxes Depreciation Cash From Accounts Receivable Cash From Inventory Cash From Accounts Payable Subtotal CASH FROM INVESTING Capital Expenditure \( (6,000) \) \( (6,500) \quad(6,250) \) Subtotal CASH FROM FINANCING Change in Long-Term Debt Change in Revolving Credit Line Change in Common Equity Dividends Subtotal CASH BALANCE Beginning of the Year Increase / (Decrease) End of the Year Case Study A Page 6 of 16

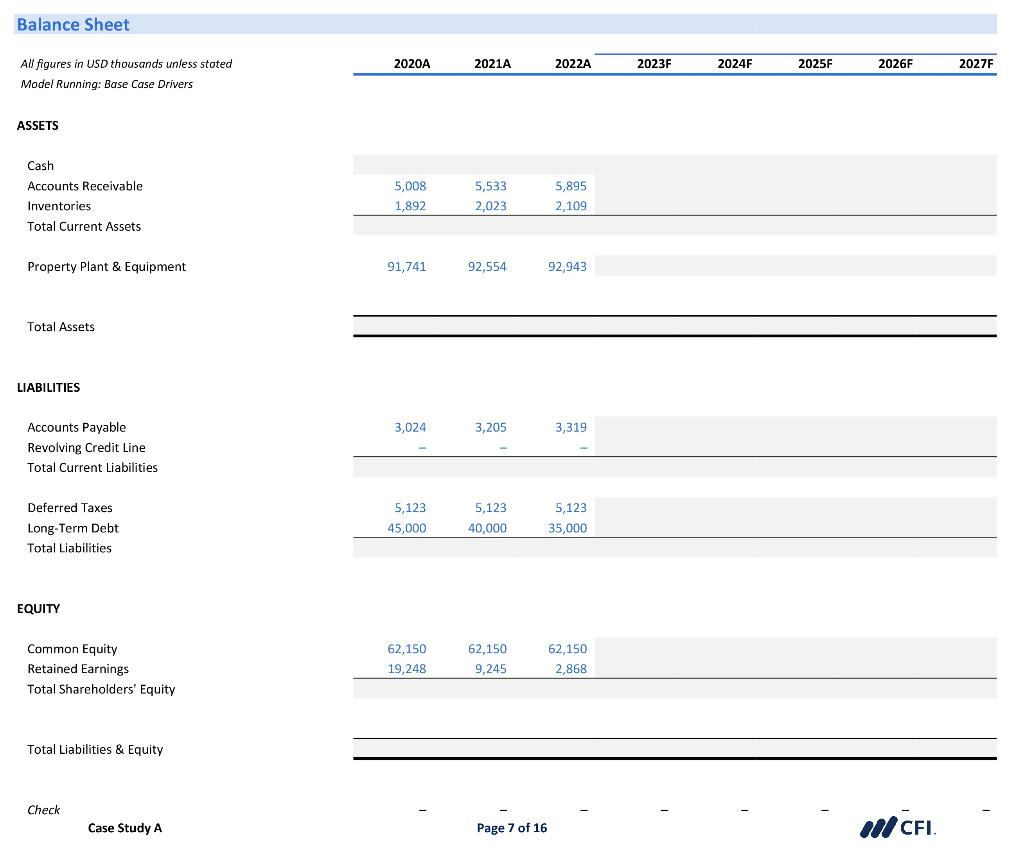

Balance Sheet All figures in USD thousands unless stoted \begin{tabular}{llllllll} \( 2020 \mathrm{~A} \) & \( 2021 \mathrm{~A} \) & \( 2022 \mathrm{~A} \) & \( 2023 \mathrm{~F} \) & \( 2024 F \) & \( 2025 F \) & \( 2026 F \) & \( 2027 \mathrm{~F} \) \\ \hline \end{tabular} Model Running: Base Case Drivers ASSETS Cash Accounts Receivable Inventories \begin{tabular}{lll} 5,008 & 5,533 & 5,895 \\ 1,892 & 2,023 & 2,109 \\ \hline \end{tabular} Total Current Assets Property Plant \& Equipment \( 91,741 \quad 92,554 \quad 92,943 \) Total Assets LIABILITIES Accounts Payable Revolving Credit Line Total Current Liabilities Deferred Taxes Long-Term Debt Total Liabilities EQUITY Common Equity Retained Earnings Total Shareholders' Equity \begin{tabular}{rrr} 5,123 & 5,123 & 5,123 \\ 45,000 & 40,000 & 35,000 \\ \hline \end{tabular} Total Liabilities \& Equity Check Case Study A \begin{tabular}{rrr} 62,150 & 62,150 & 62,150 \\ 19,248 & 9,245 & 2,868 \\ \hline \end{tabular}

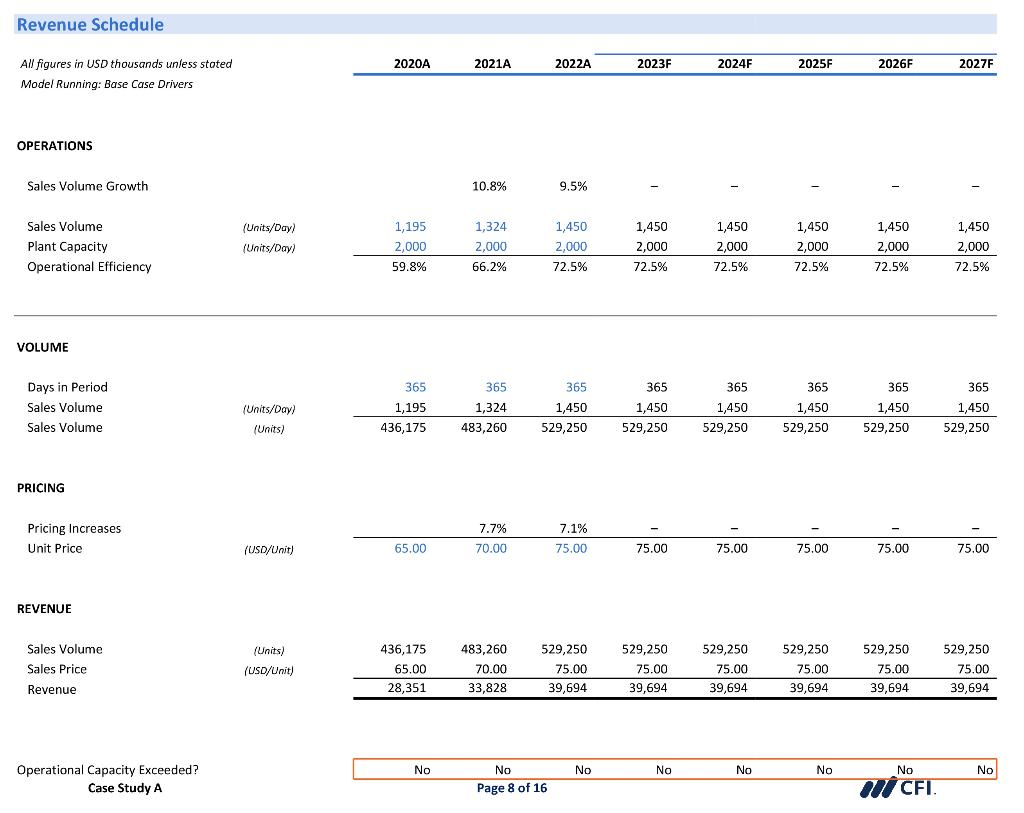

Revenue Schedule All figures in USD thousands unless stoted Model Running: Base Case Drivers OPERATIONS Sales Volume Growth \begin{tabular}{rrrrrrrrr} & \( 10.8 \% \) & \( 9.5 \% \) & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) \\ 1,195 & 1,324 & 1,450 & 1,450 & 1,450 & 1,450 & 1,450 & 1,450 \\ 2,000 & 2,000 & 2,000 & 2,000 & 2,000 & 2,000 & 2,000 & 2,000 \\ \hline \( 59.8 \% \) & \( 66.2 \% \) & \( 72.5 \% \) & \( 72.5 \% \) & \( 72.5 \% \) & \( 72.5 \% \) & \( 72.5 \% \) & \( 72.5 \% \) \end{tabular} Sales Volume Plant Capacity Operational Efficiency (Units/Day) VOLUME Days in Period Sales volume Sales Volume (Units/Day) (Units) \begin{tabular}{rrrrrrrrr} 365 & 365 & 365 & 365 & 365 & 365 & 365 & 365 \\ 1,195 & 1,324 & 1,450 & 1,450 & 1,450 & 1,450 & 1,450 & 1,450 \\ \hline 436,175 & 483,260 & 529,250 & 529,250 & 529,250 & 529,250 & 529,250 & 529,250 \end{tabular} PRICING Pricing Increases Unit Price (USD/Unit) \begin{tabular}{cccccccc} & \( 7.7 \% \) & \( 7.1 \% \) & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) \\ \hline \( 65.00 \) & \( 70.00 \) & \( 75.00 \) & \( 75.00 \) & \( 75.00 \) & \( 75.00 \) & \( 75.00 \) & \( 75.00 \) \end{tabular} REVENUE Sales Volume Sales Price Revenue \begin{tabular}{crrrrrrrrr} (Units) & 436,175 & 483,260 & 529,250 & 529,250 & 529,250 & 529,250 & 529,250 & 529,250 \\ (USD/Unit) & 65,00 & \( 70.00 \) & \( 75.00 \) & 75,00 & \( 75.00 \) & \( 75.00 \) & 75,00 & \( 75.00 \) \\ \cline { 2 - 8 } & 28,351 & 33,828 & 39,694 & 39,694 & 39,694 & 39,694 & 39,694 & 39,694 \\ \hline \end{tabular} Operational Capacity Exceeded? Case Study A \begin{tabular}{|ccccccc} \hline No & No & No & No & No & No & No \\ \hline & Page 8 of 16 & & & No \\ \hline \end{tabular}

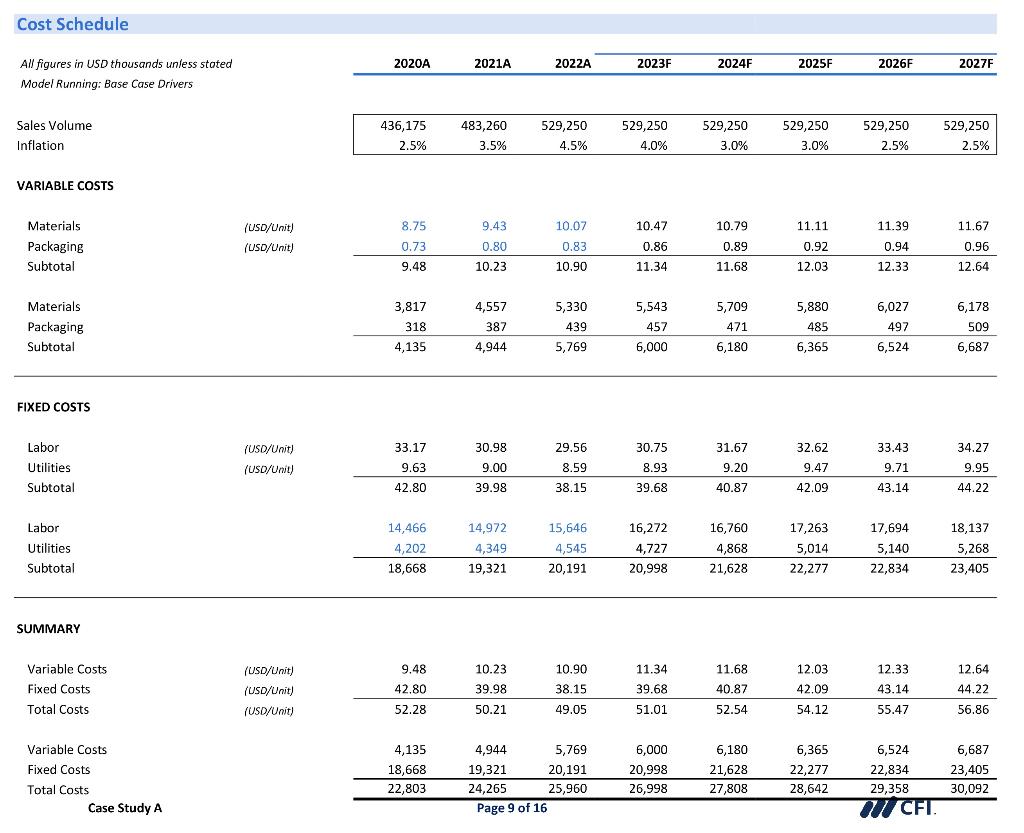

Cost Schedule All figures in USD thousands unless stated Model Running: Base Case Drivers Sales Volume Inflation \begin{tabular}{|rrrrrrrr|} \hline 436,175 & 483,260 & 529,250 & 529,250 & 529,250 & 529,250 & 529,250 & 529,250 \\ \( 2.5 \% \) & \( 3.5 \% \) & \( 4.5 \% \) & \( 4.0 \% \) & \( 3.0 \% \) & \( 3.0 \% \) & \( 2.5 \% \) & \( 2.5 \% \) \\ \hline \end{tabular} VARIABLE COSTS FIXED COSTS SUMMARY Variable Costs Fixed Costs Total Costs (USD/Unit) (USD/Unit) (USD/Unit) \begin{tabular}{rrrrrrrr} \( 9.48 \) & \( 10.23 \) & \( 10.90 \) & \( 11.34 \) & \( 11.68 \) & \( 12.03 \) & \( 12.33 \) & \( 12.64 \) \\ \( 42.80 \) & \( 39.98 \) & \( 38.15 \) & \( 39.68 \) & \( 40.87 \) & \( 42.09 \) & \( 43.14 \) & \( 44.22 \) \\ \hline \( 52.28 \) & \( 50.21 \) & \( 49.05 \) & \( 51.01 \) & \( 52.54 \) & \( 54.12 \) & \( 55.47 \) & \( 56.86 \) \end{tabular} Variable Costs Fixed Costs Total Costs Case Study A \begin{tabular}{rrrrrrrrr} 4,135 & 4,944 & 5,769 & 6,000 & 6,180 & 6,365 & 6,524 & 6,687 \\ 18,668 & 19,321 & 20,191 & 20,998 & 21,628 & 22,277 & 22,834 & 23,405 \\ \hline 22,803 & 24,265 & 25,960 & 26,998 & 27,808 & 28,642 & 29,358 & 30,092 \\ \hline \multicolumn{1}{c}{ Page 9 of 16} & & & CFI. \end{tabular}

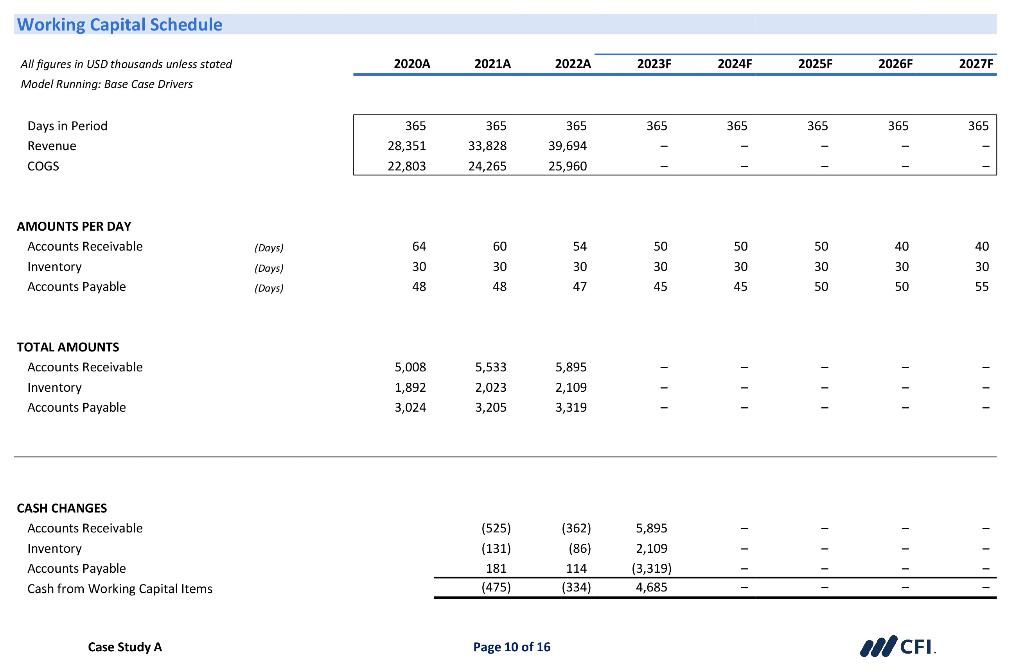

Working Capital Schedule All figures in USD thousands uniess stoted \( \begin{array}{llllllll}2020 \mathrm{~A} & 2021 \mathrm{~A} & 2022 \mathrm{~A} & 2023 \mathrm{~F} & 2024 \mathrm{~F} & 2025 \mathrm{~F} & 2026 \mathrm{~F} & 2027 F\end{array} \) Model Running: Base Case Drivers Days in Period Revenue COGS \begin{tabular}{|rrrrrrrrrr} \hline 365 & 365 & 365 & 365 & 365 & 365 & 365 & \( - \) & \( - \) \\ 28,351 & 33,828 & 39,694 & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) \\ 22,803 & 24,265 & 25,960 & \( - \) & \( - \) & \( - \) & \( - \) \\ \hline \end{tabular} AMOUNTS PER DAY Accounts Receivable Inventory Accounts Payable \( \begin{array}{llllllll}\text { (Days) } & 64 & 60 & 54 & 50 & 50 & 50 & \\ \text { (Doys) } & 30 & 30 & 30 & 30 & 30 & 30 \\ \text { (Doys) } & 48 & 48 & 47 & 40 & 50\end{array} \) TOTAL AMOUNTS Accounts Receivable Inventory Accounts Payable \( \begin{array}{lll}5,008 & 5,533 & 5,895 \\ 1,892 & 2,023 & 2,109 \\ 3,024 & 3,205 & 3,319\end{array} \) CASH CHANGES Accounts Receivable Inventory Accounts Payable Cash from Working Capital Items \begin{tabular}{cccccc} \( (525) \) & \( (362) \) & 5,895 & \( - \) & \( - \) & \( - \) \\ \( (131) \) & \( (86) \) & 2,109 & \( - \) & \( - \) & \( - \) \\ 181 & 114 & \( (3,319) \) & \( - \) & \( - \) & \( - \) \\ \hline\( (475) \) & \( (334) \) & 4,685 & \( - \) & \( - \) & \( - \) \\ \hline \end{tabular} Case Study A Page 10 of 16 \( N / \) CFI.

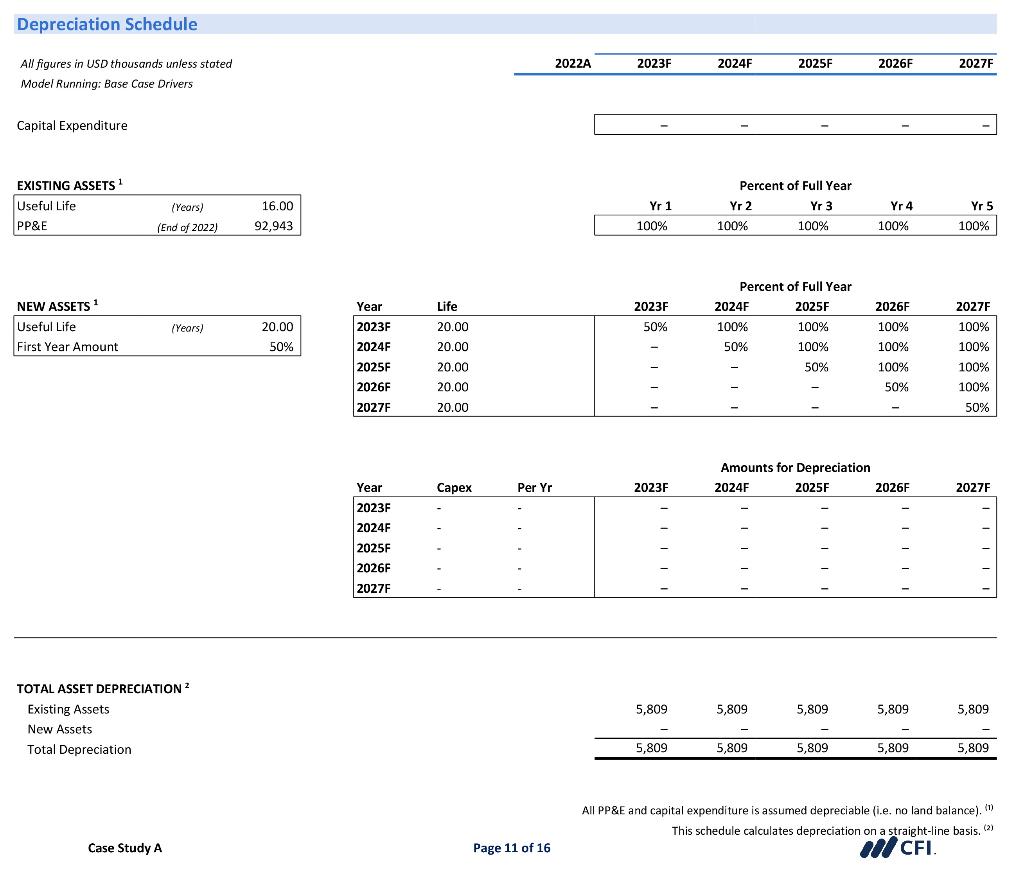

All figures in USD thousands unless stated Model Running: Base Case Drivers Capital Expenditure TOTAL ASSET DEPRECIATION 2 Existing Assets New Assets Total Depreciation All PP\&E and capital expenditure is assumed depreciable (i.e. no land balance). (1) This schedule calculates depreciation on a straight-line basis. \( { }^{\text {(2) }} \) Case Study A Page 11 of 16 \( 00 \mathrm{CFI} \).

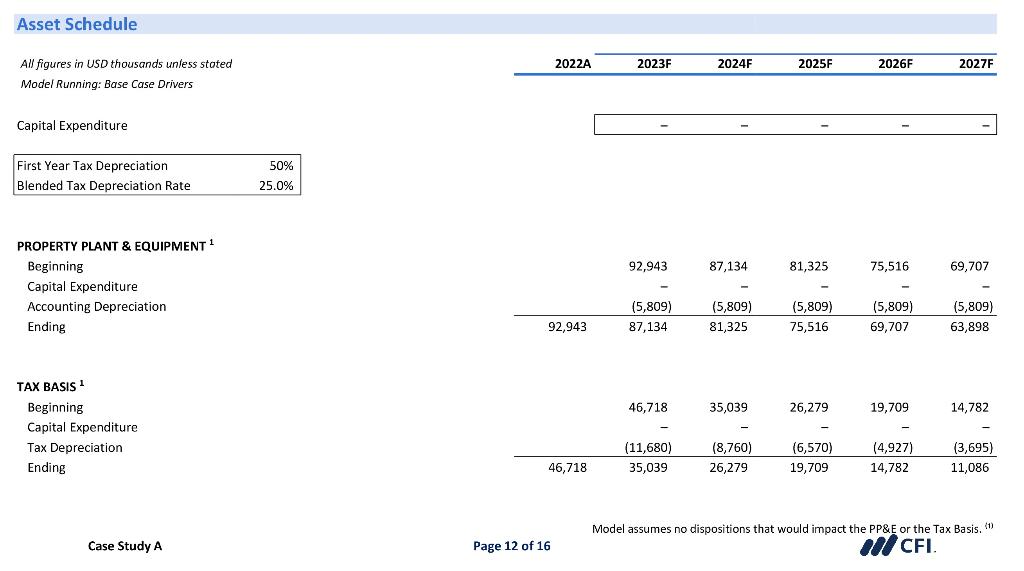

All figures in USD thousands unless stoted Model Running: Base Case Drivers Capital Expenditure PROPERTY PLANT \& EQUIPMENT \( { }^{1} \) Beginning Capital Expenditure Accounting Depreciation Ending TAX BASIS \( ^{1} \) Beginning Capital Expenditure Tax Depreciation Ending Model assumes no dispositions that would impact the PP\&E or the Tax Basis. \( { }^{\text {(1) }} \) Case Study A Page 12 of 16 \( 01 \mathrm{CFI} \).

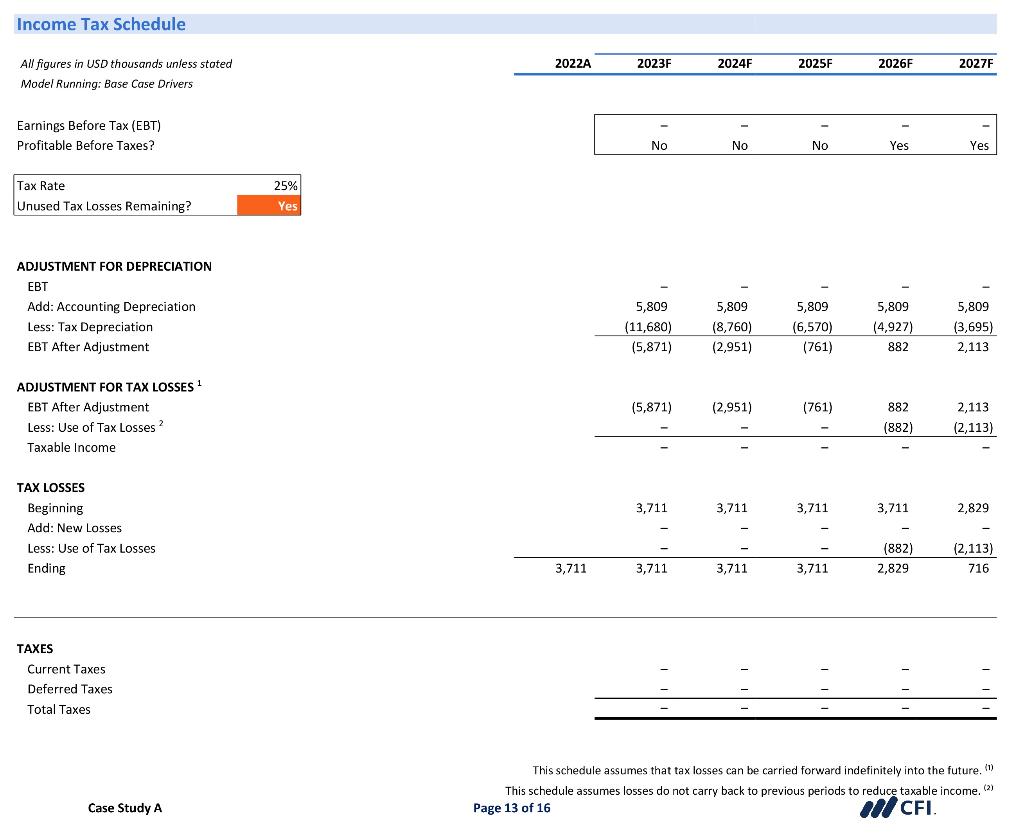

Income Tax Schedule All figures in USD thousands unless stated \begin{tabular}{llllll} \cline { 2 - 6 } \( 2022 \mathrm{~A} \) & \( 2023 \mathrm{~F} \) & \( 2024 \mathrm{~F} \) & \( 2025 \mathrm{~F} \) & \( 2026 \mathrm{~F} \) & \( 2027 \mathrm{~F} \) \\ \hline \end{tabular} Model Running: Base Case Drivers Earnings Before Tax (EBT) Profitable Before Taxes? \begin{tabular}{rrrrrr|} \hline\( - \) & \( - \) & \( - \) & \( - \) & \( - \) \\ No & No & No & Yes & Yes \\ \hline \end{tabular} \begin{tabular}{|lr|} \hline Tax Rate & \( 25 \% \) \\ \hline Unused Tax Losses Remaining? & Yes \\ \hline \end{tabular} ADJUSTMENT FOR DEPRECIATION EBT Add: Accounting Depreciation Less: Tax Depreciation EBT After Adjustment \begin{tabular}{ccccc} 5,809 & 5,809 & 5,809 & 5,809 & 5,809 \\ \( (11,680) \) & \( (8,760) \) & \( (6,570) \) & \( (4,927) \) & \( (3,695) \) \\ \hline\( (5,871) \) & \( (2,951) \) & \( (761) \) & 882 & 2,113 \end{tabular} ADJUSTMENT FOR TAX LOSSES \( { }^{1} \) EBT After Adjustment Less: Use of Tax Losses \( { }^{2} \) Taxable Income \begin{tabular}{rrrrr} \( (5,871) \) & \( (2,951) \) & \( (761) \) & 882 & 2,113 \\ \( - \) & \( - \) & \( - \) & \( (882) \) & \( (2,113) \) \\ \hline\( - \) & \( - \) & \( - \) & \( - \) & \( - \) \end{tabular} TAX LOSSES Beginning \begin{tabular}{rrrrrr} & 3,711 & 3,711 & 3,711 & 3,711 & 2,829 \\ & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) \\ & \( - \) & \( - \) & \( - \) & \( (882) \) & \( (2,113) \) \\ \hline 3,711 & 3,711 & 3,711 & 3,711 & 2,829 & 716 \end{tabular} Add: New Losses Less: Use of Tax Losses Ending TAXES Current Taxes Deferred Taxes Total Taxes \begin{tabular}{rrrrr} \( - \) & \( - \) & \( - \) & \( - \) & \( - \) \\ \hline\( - \) & \( - \) & \( - \) & \( - \) & \( - \) \\ \hline \end{tabular} This schedule assumes that tax losses can be carried forward indefinitely into the future, \( { }^{(1)} \) This schedule assumes losses do not carry back to previous periods to reduce taxable income. \( { }^{(2)} \) Case Study A Page 13 of 16 01 CFI.

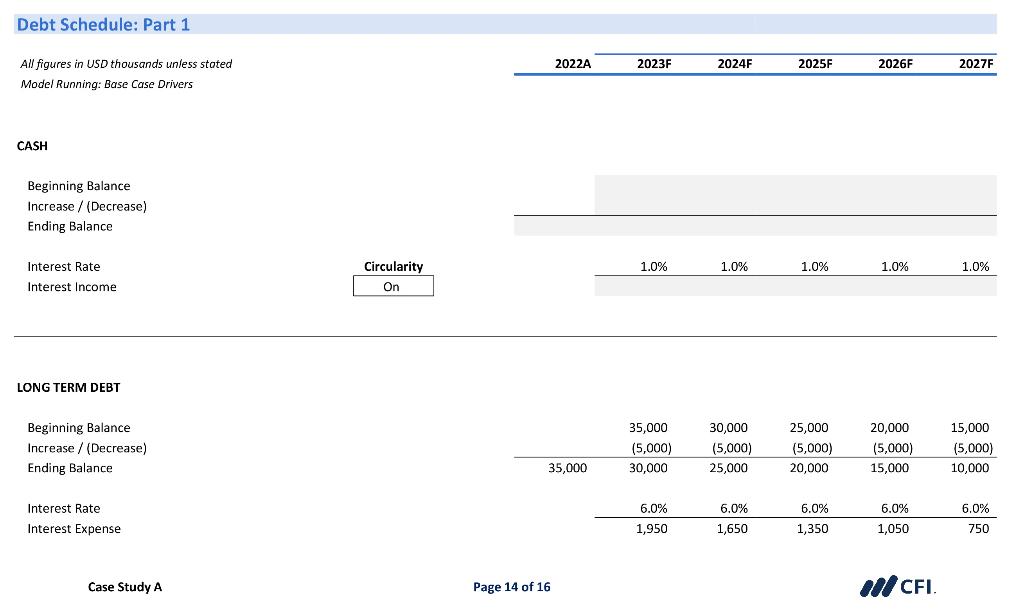

Debt Schedule: Part 1 All figures in USD thousands unless stated \begin{tabular}{llllll} \hline \( 2022 \mathrm{~A} \) & \( 2023 F \) & \( 2024 F \) & \( 2025 F \) & \( 2026 F \) & \( 2027 F \) \\ \hline \end{tabular} Model Running: Base Case Drivers CASH Beginning Balance Increase / (Decrease) Ending Balance Interest Rate Interest Income \begin{tabular}{c} Circularity \\ \hline On \\ \hline \end{tabular} \begin{tabular}{lllll} \( 1.0 \% \) & \( 1.0 \% \) & \( 1.0 \% \) & \( 1.0 \% \) & \( 1.0 \% \) \\ \hline \end{tabular} LONG TERM DEBT Beginning Balance Increase / (Decrease) Ending Balance \begin{tabular}{cccccc} & 35,000 \( (5,000) \) & 30,000 \( (5,000) \) & 25,000 \( (5,000) \) & 20,000 \( (5,000) \) & 15,000 \( (5,000) \) \\ \hline 35,000 & 30,000 & 25,000 & 20,000 & 15,000 & 10,000 \end{tabular} Interest Rate Interest Expense \begin{tabular}{rrrrr} \( 6.0 \% \) & \( 6.0 \% \) & \( 6.0 \% \) & \( 6.0 \% \) & \( 6.0 \% \) \\ \hline 1,950 & 1,650 & 1,350 & 1,050 & 750 \end{tabular} Case Study A Page 14 of 16 \( A N \) CFI.

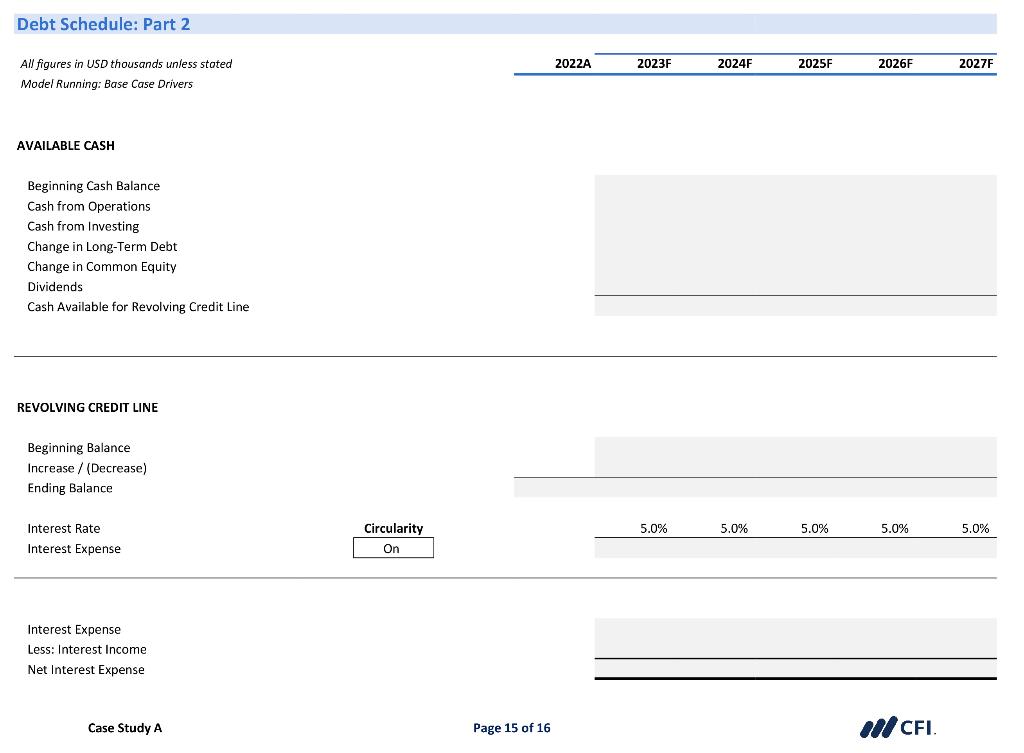

Debt Schedule: Part 2 All figures in USD thousands unless stated \begin{tabular}{llllll} \hline \( 2022 \mathrm{~A} \) & \( 2023 \mathrm{~F} \) & \( 2024 \mathrm{~F} \) & \( 2025 \mathrm{~F} \) & \( 2026 \mathrm{~F} \) & \( 2027 \mathrm{~F} \) \\ \hline \end{tabular} Model Running: Base Case Drivers AVAILABLE CASH Beginning Cash Balance Cash from Operations Cash from Investing Change in Long-Term Debt Change in Common Equity Dividends Cash Available for Revolving Credit Line REVOLVING CREDIT LINE Beginning Balance Increase / (Decrease) Ending Balance Interest Rate Interest Expense \begin{tabular}{c} Circularity \\ \hline On \\ \hline \end{tabular} \begin{tabular}{lllll} \( 5.0 \% \) & \( 5.0 \% \) & \( 5.0 \% \) & \( 5.0 \% \) & \( 5.0 \% \) \\ \hline \end{tabular} Interest Expense Less: Interest Income Net Interest Expense Case Study A Page 15 of 16 \( A / C F I \).

Equity Schedule All figures in USD thousands unless stoted \( 2022 \mathrm{~A} \quad \) 2023F \( 2024 \mathrm{~F} \quad 2025 \mathrm{~F} \quad 2026 \mathrm{~F} \quad 2027 \mathrm{~F} \) Model Running: Base Case Drivers COMMON EQUITY Beginning Balance Increase / (Decrease) Ending Balance \begin{tabular}{rrrrrr} & 62,150 & 62,150 & 62,150 & 62,150 & 62,150 \\ & \( - \) & \( - \) & \( - \) & \( - \) & \( - \) \\ \hline 62,150 & 62,150 & 62,150 & 62,150 & 62,150 & 62,150 \end{tabular} Net Income Payout Ratio Dividend \begin{tabular}{lllll} \( 25.0 \% \) & \( 25.0 \% \) & \( 25.0 \% \) & \( 25.0 \% \) & \( 25.0 \% \) \\ \hline \end{tabular} RETAINED EARNINGS Beginning Balance Net Income Dividends Ending Balance Case Study A Page 16 of 16 \begin{tabular}{rrrcr} 2,868 & 2,868 & 2,868 & 2,868 & 2,868 \\ \( - \) & \( - \) & \( - \) & \( - \) & \( - \) \\ \( - \) & \( - \) & \( - \) & \( - \) & \( - \) \\ \hline 2,868 & 2,868 & 2,868 & 2,868 & 2,868 \\ & & & \( 2 C^{2} \) CFI. \end{tabular}